(This is an excerpt from an article I originally published on Seeking Alpha on July 13, 2012. Click here to read the entire piece.)

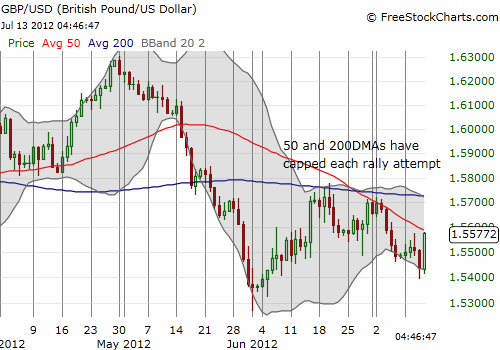

After another pins and needles rally back to the 50DMA resistance, I think it is time to switch to a more bearish strategy on the British pound (FXB).

Since mid-June, I have recommended buying the dips and selling the subsequent rallies on the British pound (also see “So Far So Good On Buying Dips In British Pound“). This strategy has been very successful, but this latest round has me considering reversing the strategy. Shorting at resistance over the past month would have provided precise entry points whereas by buying dips, I have had to accumulate a position until a subsequent rally took me out at a profit. I greatly prefer precision on entry because it is much easier to manager risk.

{snip}

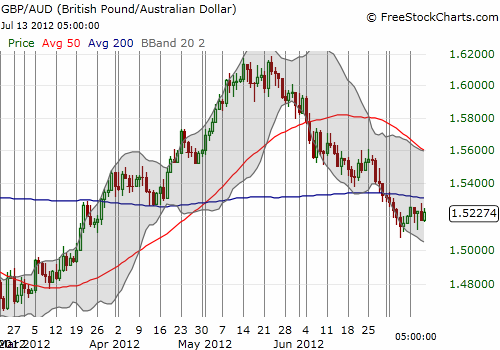

In the meantime, supporting my more bearish outlook is the near constant sell-off of the pound against the Australian dollar. {snip}

Source for charts: FreeStockCharts.com

I am not making the Australian dollar (FXA) the centerpiece of my new bearish outlook on the pound because I recently switched back to a net bearish bet against the Australian dollar (for example, see “Remaining Bearish On Australian Dollar As The RBA Braces For More Financial Turmoil“). However, if financial markets overall become more bullish, betting against the pound with the Australian dollar will become quite attractive.

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on July 13, 2012. Click here to read the entire piece.)

Full disclosure: net short the British pound and Australian dollar