(This is an excerpt from an article I originally published on Seeking Alpha on July 6, 2012. Click here to read the entire piece.)

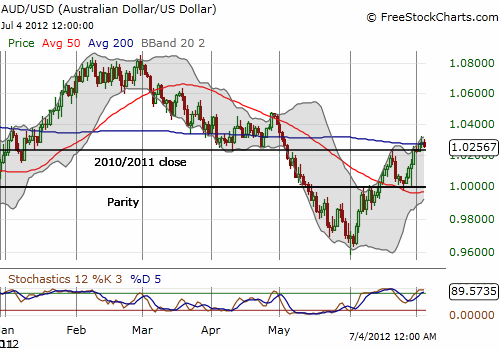

The Australian dollar’s year-to-date performance against the U.S. dollar (FXA) is back to even. The leading “risk-on” currency has fought back from a large one month slide that featured losses of as much as 8.5%. It was also a time when the economic data seemed to confirm a weakening Australian economy. The numbers since the recent bottom now seem to indicate that the economy is just fine. Indeed, in its latest monetary policy decision, the Reserve Bank of Australia (RBA) seemed much more concerned about macro-economic forces beyond its borders than domestic developments {snip}.

{snip}

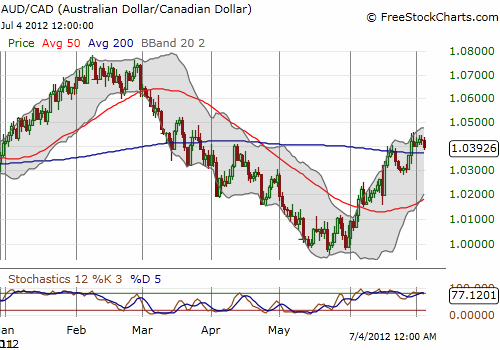

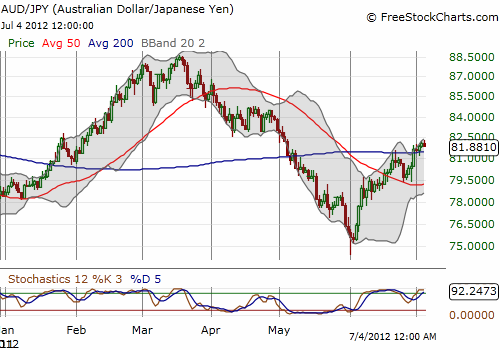

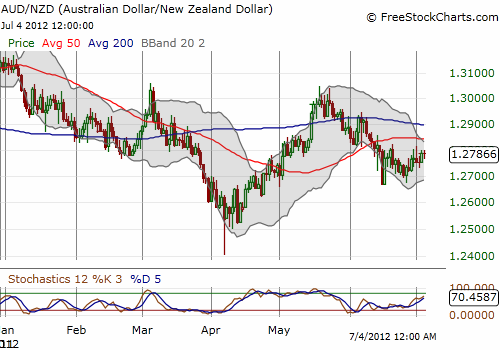

At the same time the Australian dollar has come roaring back, it has maintained the near perfect correlation it re-achieved with the S&P 500 (SPY) in May after three months of divergence (for an example, see this article from late May: “Correlations Are Broken But Australian Dollar Still Leads The S&P 500“). Thus, the Australian dollar in a sense is confirming the S&P 500’s comeback from the June low. I continue to look for divergences that could flag an imminent change in the nature of the stock market’s rally.

{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on July 6, 2012. Click here to read the entire piece.)

Full disclosure: net short Australian dollar