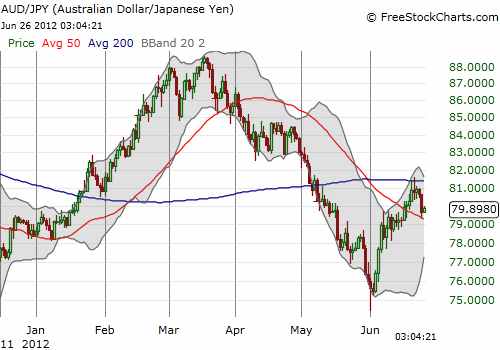

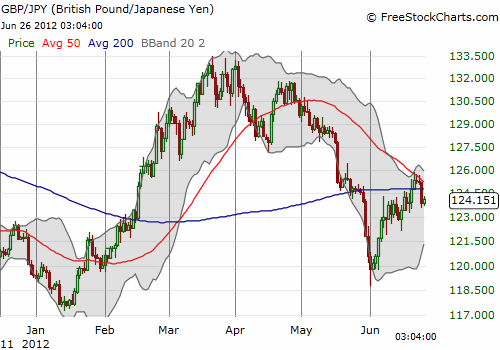

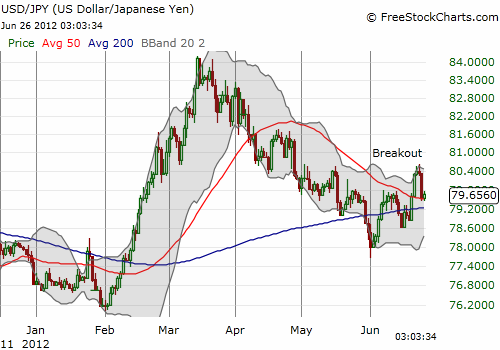

I earlier argued that the Japanese yen held a critical piece of the puzzle to determining what’s next for risk attitudes (see “The Japanese Yen And Volatility Sit At The Cusp Of Renewed Risk Aversion”). On Monday, the yen seemed to confirm that risk aversion is indeed returning and likely to stay with us for a while. The yen soared in strength on Monday and in each of the major currency pairs shown in the charts below, excluding USD/JPY, the yen ended its recent weakness directly at important resistance levels (mostly the 50-day moving average (DMA)). In the case of USD/JPY, important support is getting tested that I think will determine whether the U.S. dollar is truly going to assist the Japanese yen in sopping up risk aversion.

As I type the U.S. dollar is pulling back against all major currencies. The key going forward will be whether the yen follows suit. For now, I am expecting the market to tentatively continue to bet on the Federal Reserve eventually coming through with more easing and for the market to continue to seek refuge in the yen whenever headlines dictate fresh fears.

Be careful out there!

Full disclosure: net short U.S. dollar, net long Japanese yen