(T2108 measures the percentage of stocks trading above their respective 40-day moving averages [DMAs]. To learn more about it, see my T2108 Resource Page. You can follow real-time T2108 commentary on twitter using the #T2108 hashtag. T2108-related trades and other trades are posted on twitter using the #120trade hashtag)

T2108 Status: 34.9%

VIX Status: 20.1

General (Short-term) Trading Call: Hold with bearish hedges

Reference Charts (click for view of last 6 months from Stockcharts.com):

S&P 500 or SPY

SDS (ProShares UltraShort S&P500)

U.S. Dollar Index (volatility index)

VIX (volatility index)

VXX (iPath S&P 500 VIX Short-Term Futures ETN)

EWG (iShares MSCI Germany Index Fund)

CAT (Caterpillar)

Commentary

The churn continues as my “firm bullishness” from two days ago quickly turns into increased caution. This period was so brief, I barely had a chance to expand my short-term bullish positions (I added a handful of JKS shares to my SSO shares and Siemens call options), and I instead find myself with more bearish ones, mainly in the form of more VXX call options and shares.

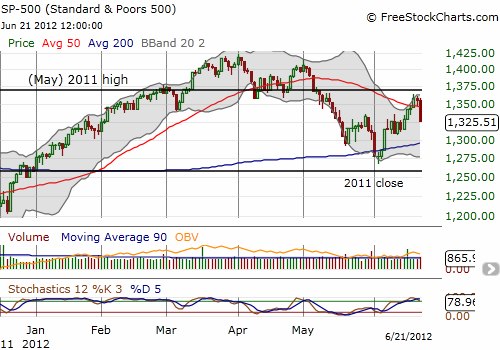

T2108 was crushed on Thursday, dropping from 52% to 35% (directly above the 50DMA for T2108). The S&P 500 dropped 2.2%, placing it below its 50DMA again and erasing my earlier bullishness. Note well that this sharp drop is what I would normally expect for the index to work off extremely overbought stochastics. If the index remains healthy, it will bounce back quickly. I am not optimistic in the short-term given the drop below the important support now turned resistance again at the 50DMA.

Note how the S&P 500 also fell below the previous resistance formed by the highs following May’s oversold period. The index will need to re-fight its way if it bounces from here. Ultimately, we should watch to see whether a trading range sustains itself between the 2011 high (in May) and the 2011 close.

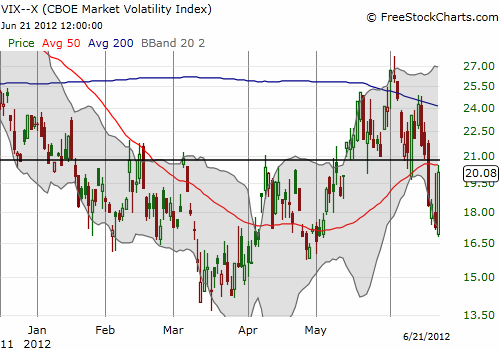

As I expected, volatility was crushed after the Fed announcement, but on Thursday it soared as if it was responding to pent-up demand. The VIX is now again knocking on the door of the critical 21 level.

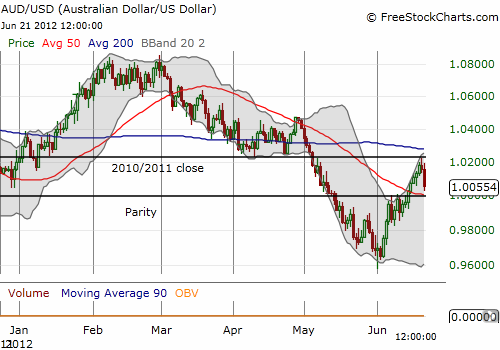

This all adds up to a likely increase in risk aversion. For more details on my related thoughts see “The Japanese Yen And Volatility Sit At The Cusp Of Renewed Risk Aversion.” The Australian dollar further confirms the flee from risk. The currency plunged against the U.S. dollar and almost dropped back to parity after a very strong run. It maintained perfect resistance at the 2010/2011 close.

At this point, a lot of caution is warranted. The S&P 500 has to climb above 50DMA resistance yet again for me to throw some caution to the wind. Even then, the additional resistance of the May highs from 2011 and 2012 await. Otherwise, I wait for another oversold reading.

Finally, note that the cyclical indicator in Caterpillar (CAT) continues to flash red. The stock never benefited much from the previous rally, it remains negative for the year, and it has been unable to challenge that resistance since late May. CAT also had another sales report and analyst presentation this week that failed to impress the market.

Daily T2108 vs the S&P 500

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Weekly T2108

*All charts created using freestockcharts.com unless otherwise stated

Related links:

The T2108 Resource Page

Expanded daily chart of T2108 versus the S&P 500

Expanded weekly chart of T2108

Be careful out there!

Full disclosure: long SDS, SSO; long VXX calls, puts, and shares; long SI calls; long CAT, long JKS