(This is an excerpt from an article I originally published on Seeking Alpha on June 19, 2012. Click here to read the entire piece.)

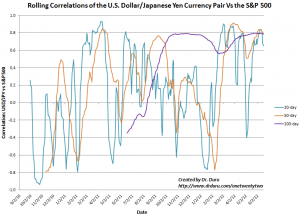

{snip} I was looking for confirmation of the increasingly bullish outlook, but I did not get it. In “Bearish Implications of A Rare Convergence of Extremes in Yen vs S&P 500 Correlations“…{snip}…I concluded that the extreme convergence of the 20 and 50DMAs signaled a sell-off in the S&P 500 {snip}. Three weeks later, the S&P 500 peaked. {snip} The 20 and 50DMAs have converged yet again, along with the 200DMA. {snip}

Click to view larger images…

Source: Prices from FreeStockCharts.com

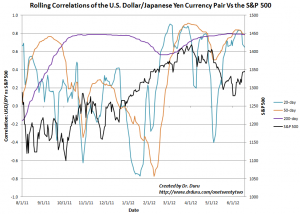

{snip}…the Australian dollar versus the U.S. dollar (AUD/USD) has synchronized with the S&P 500 once again. In “Correlations Are Broken But Australian Dollar Still Leads The S&P 500” on May 26th, I pointed out how the Australian dollar, using the CurrencyShares Australian Dollar Trust (FXA) as a sufficient currency proxy, has frequently led the performance in the S&P 500. {snip}

Click for larger views…

Source: Yahoo!Finance

I was hoping for the Australian dollar and the S&P 500 to diverge again to provide a signal for a likely path forward. Instead, my assumption that the Australian dollar will soon resume its downtrend implies that the S&P 500 will also turn south – either together or with the Australian dollar leading the way. {snip}

{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on June 19, 2012. Click here to read the entire piece.)

Full disclosure: net long Japanese yen, net short Australian dollar, long SDS