On Friday, the Australian dollar (FXA) enjoyed continued strength as financial markets rallied strongly into the close ahead of Sunday’s potential turmoil with Greek elections. Just two days ago, I wrote that I switched back to a bearish stance on AUD/USD after it reached my relief rally target of parity. I also said that “I am on alert for a bullish breakout.” The breakout could already be unfolding.

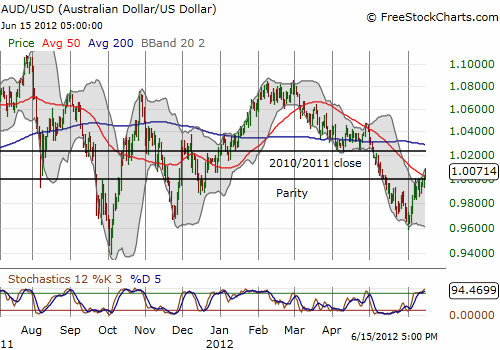

The chart below shows the importance of parity since last summer’s swoon. Parity held as support in August, 2011. Since then, all but one move toward parity has generated significant follow-through whether up or down. Even with stochastics in an overbought position, AUD/USD has recently been able to continue rallies through parity. So, Friday’s firm close above parity could indeed be a signal of continued strength. If so, the convergence of the 200DMA with the 2010 and 2011 closes becomes the next natural line of resistance.

Source: FreeStockCharts.com

For now, I am maintaining my bearish stance. I may even wait out the settling dust from the Greek elections and then this week’s Federal Reserve meeting to determine my next move. Since I am using the U.S. dollar as part of my hedge, my current position may work out just fine. (I am increasingly bearish the U.S. dollar).

Be careful out there!

Full disclosure: net short Australian dollar