(This is an excerpt from an article I originally published on Seeking Alpha on June 14, 2012. Click here to read the entire piece.)

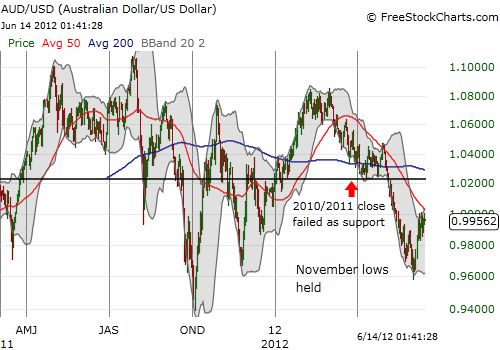

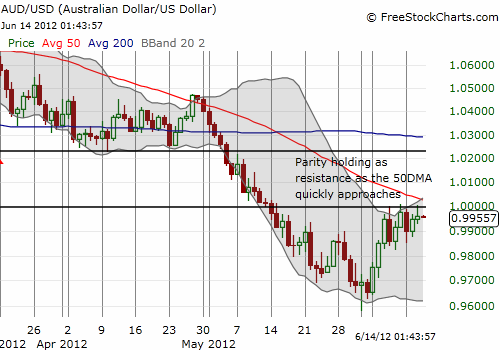

Last week, the Australian dollar (FXA) took a rest from its longest post-recession sell-off (3+ months and running). Good economic numbers with surging GDP and surprisingly strong job creation forced traders to pause and take note. The resulting relief rally took the Australian dollar quickly to my relief rally target around parity and the 50-day moving average (DMA).

{snip}

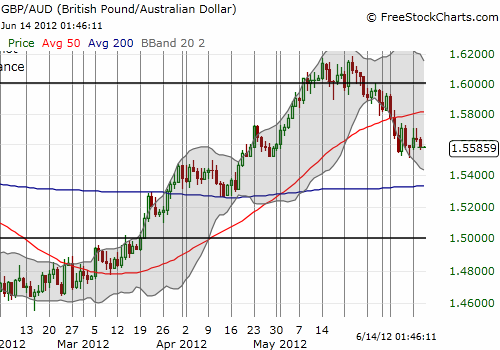

While I expect the downtrend to remain intact, I am on alert for a bullish breakout. As I have mentioned before, I am not expecting the Reserve Bank of Australia to continue cutting rates without some fresh macro-economic shock to force its hand. Assuming the market comes around to my line of thinking, downside should be limited to somewhere around the recent lows – meaning the overall short-term sell-off is coming to an end. We can see the change in fortunes in the Australian dollar’s ability to trade well against the British pound (GBP/AUD) over the last three weeks. {snip}

Source for charts: FreeStockCharts.com

{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on June 14, 2012. Click here to read the entire piece.)

Full disclosure: net short Australian dollar