(This is an excerpt from an article I originally published on Seeking Alpha on June 5, 2012. Click here to read the entire piece.)

Futures estimated a 63% chance that the Reserve Bank of Australia (RBA) would cut rates by 50 basis points tonight, but the RBA went with the analyst consensus of a 25 basis point cut to 3.50%. In its statement on monetary policy, the RBA seemed to meander across economic data points more than usual. The two main concerns now are the on-going sovereign debt crisis in Europe and housing prices that have started to decline again. With “interest rates for borrowers…a little below their medium-term averages,” the RBA is officially accomodative and stated as much. However, unlike previous statements, the RBA did not seem to give strong guidance going forward.

Perhaps the key will be expectations for inflation:

{snip}

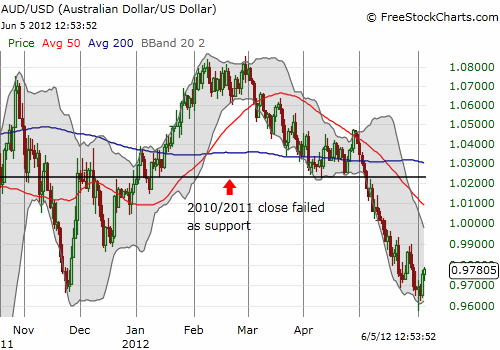

The Australian dollar has declined for three months almost non-stop. A relief rally back to parity, and perhaps a little higher to meet resistance at the 50-day moving average (DMA) seems like a high probability outcome for the near-term. Beyond that, the outlook for the Australian dollar remains bearish.

{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on June 5, 2012. Click here to read the entire piece.)

Full disclosure: net long Australian dollar