(This is an excerpt from an article I originally published on Seeking Alpha on May 21, 2012. Click here to read the entire piece.)

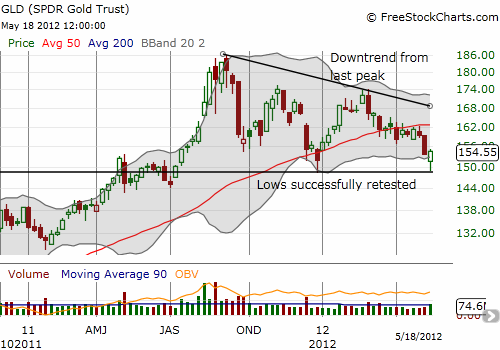

Gold and silver have languished since reaching their last peaks in 2011. {snip} Last week, gold and silver reawakened and made sharp reversals. {snip}

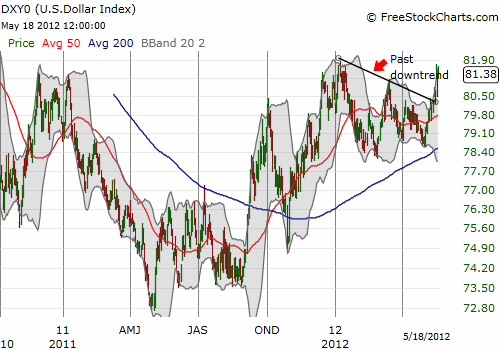

Note that the dollar’s resurgence since hitting a bottom a year ago explains most of the weakness in gold and silver {snip} Neither gold nor silver will be completely out of the penalty box until they each break their respective near-term downtrends as shown above.

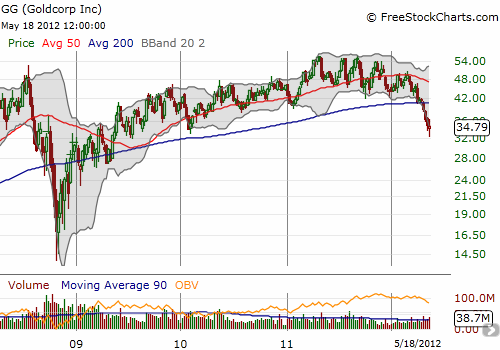

The stocks of miners of gold and silver have suffered even greater losses than the underlying precious metals. {snip}

Source for charts: FreeStockCharts.com

{snip} On Friday, Fleck wrote “Gold’s fortunes will soon reverse.” In that piece, he makes several provocative observations, including a quantification of the amazingly low valuation for PAAS {snip}:

{snip}

{snip} If you do not have any exposure to gold or silver, this is a great time to start with a sizable position and then plan to add in increments if the market serves up yet lower prices. If you already have a sizable position, then now is the time to nibble on some more of your favorite choices in precious metals. {snip}

{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on May 21, 2012. Click here to read the entire piece.)

Full disclosure: long GLD, SLV, GG, and PAAS