(This is an excerpt from an article I originally published on Seeking Alpha on May 20, 2012. Click here to read the entire piece.)

BHP Billiton (BHP) Chairman Jacques Nasser raised eyebrows in a discussion with reporters on Wednesday, May 16th when he indicated that commodity prices are likely to keep falling for now:

“The tail winds of high commodity prices have contributed to record growth in the sector. Now we have a period where those tail winds are moderating and we expect further easing over time…”

Nasser also indicated that BHP would not follow-through with plans to spend $80B over five years expanding its various mining businesses.

These statements immediately brought back into focus my commodity crash playbook. {snip}

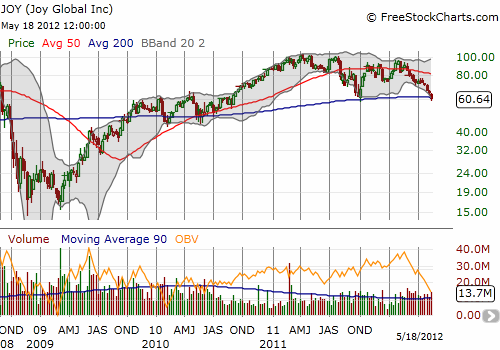

Last August, Joy Global (JOYG) talked bullishly about the demand for its equipment because of the need to expand and develop mines to meet the growing demands of China and other emerging markets (see “Despite Bullish Outlook from Joy Global, the ‘Commodity Crash’ Playbook Stays Active“). {snip} JOYG is now retesting 2011’s low. {snip}

I recently bought BHP shares for the first time ever as the stock approached its QE2 reference price. {snip}

Source: FreeStockCharts.com

Seeing charts like JOYG and BHP give me serious pause. {snip}

Many commentators and analysts exist who have called for the collapse of China’s economy over the last several years. {snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on May 20, 2012. Click here to read the entire piece.)

Full disclosure: long BHP