(This is an excerpt from an article I originally published on Seeking Alpha on April 30, 2012. Click here to read the entire piece.)

It’s official – the Reserve Bank of Australia (RBA) is trying to work the Australian dollar lower. In a surprise move, the RBA cut rates 50 basis points to 3.75%. Expectations were for a 25 basis point cut. In explaining the move, the RBA pointed out the large drop in inflation…

{snip}

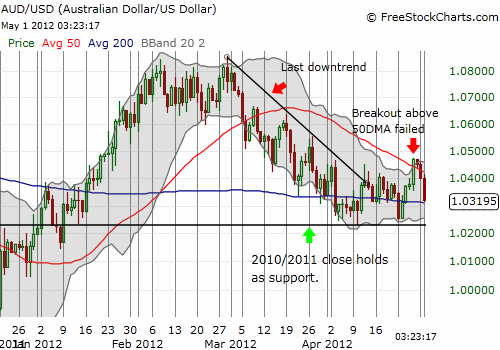

The RBA has been setting up a drop in rates for some time now…{snip}…What was new and eye-opening is that the RBA finally and officially pointed to the currency as a source of friction on economic growth (emphasis mine): “Output growth was affected in part by temporary factors, but also by the persistently high exchange rate.” If there was any doubt before, it should now be erased: the RBA wants a lower Australian dollar.

The large drop in inflation finally gave the RBA the opening it needed given even it admits that “a deep downturn is not occurring at this stage.” {snip}

Perhaps with an eye on Europe and another eye on the “subdued” housing market, the RBA decided to swallow a full 50 basis point pill as a bit of preventive medicine. {snip}

{snip}

{snip} I am going to hold onto this hedge for at least another few days as I observe the market’s full reaction…{snip}…In the meantime, I will be getting even more aggressive in (swing) trading GBP/AUD on the bullish side.

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on April 30, 2012. Click here to read the entire piece.)

Full disclosure: net long Australian dollar (but not for long)