(This is an excerpt from an article I originally published on Seeking Alpha on April 16, 2012. Click here to read the entire piece.)

On January 13th this year, I argued that it was time to buy the dips in homebuilders in preparation for a bottom sometime in 2013. I targeted KB Home (KBH) in particular. {snip}

Source: FreeStockCharts.com

The selling in KBH turned especially intense after it reported earnings last month. The stock dropped directly from its long-term downtrend and its 50DMA.

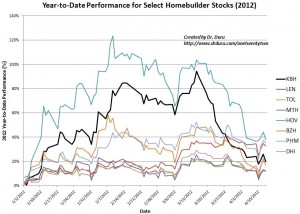

KBH’s turn in fortunes has transformed it from the second-best performing homebuilder in my universe for 2012 to a middling performer. Of course, 20% year-to-date is still enviable.

Click image for larger view:

The ranked year-to-date performances fr these homebuilders are now:

- Hovnanian Enterprises Inc. (HOV): 38%

- PulteGroup, Inc. (PHM): 35%

- Lennar Corp. (LEN): 33%

- KB Home (KBH): 20%

- DR Horton Inc. (DHI): 18%

- Beazer Homes USA Inc. (BZH): 17%

- Toll Brothers Inc. (TOL): 12%

- Meritage Homes Corporation (MTH): 12%

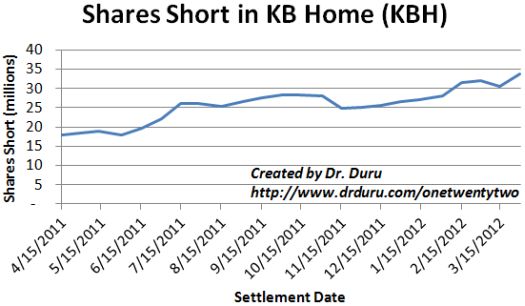

Shorts have also increased the pressure on KBH. Shares short increased 21% from the end of January to the end of March. Shorts are now an incredible 62% of KBH’s float.

Data Source: NASDAQ.com

{snip}The first buying target is $7.50…{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on April 16, 2012. Click here to read the entire piece.)

Full disclosure: long KBH shares and puts