It now looks like Monday’s deep dive in Apple (AAPL) may have indeed represented a crescendo of selling. The buyers finally showed up in Apple after taking a five-day hiatus. The results were just as impressive as ever when buyers step up for more bites of Apple. It looks like Apple’s reawakening is Apple’s revenge.

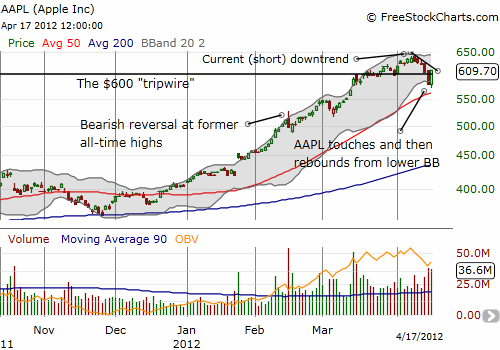

Trading in AAPL did not start well today. Even with the general stock market opening strongly, AAPL dipped as much as 1% before the buying frenzy began. By the close, AAPL erased almost all its losses from yesterday’s crescendo. In a very bullish sign, the buying volume was almost as strong as yesterday’s selling volume. Perhaps a lot of stops got hit yesterday when Apple dipped below the $600 “tripwire.” That could explain why the selling was so strong and swift. If so, yesterday’s crescendo could also represent a washout. Whatever the reason, today’s comeback should quickly generate a lot of regret with yesterday’s sellers. They are not likely to sit long before jumping back into AAPL if $600 holds. This anxiety could provide the next fuel for the stock.

The $600 level is turning into an important psychological line, and it now represents Apple’s last breakout territory (see the formation in the chart below). Follow-through from here will break April’s downtrend and likely propel Apple to fresh all-time highs (with next week’s earnings standing in the way as the unknown wildcard of course).

Source: FreeStockCharts.com

Although I too was a “seller” yesterday given I was forced to dump my short April put spread before I got assigned any shares, I feel very fortunate that I stuck by the technicals to jump back in the fray with a May call spread before yesterday’s close. In my technical review yesterday, I forgot to explain that I chose a call spread as a low risk way of rebuilding a position. It also eliminates almost all of the price of the pre-earnings premium. Similarly, I went short an April put spread last Friday because my overall risk was tightly capped. This feature turned out to be a major relief as Apple failed to hold the $605-$610 level as I had assumed at the time. (That put spread is now back to the value where I originally sold it).

If I even suspected that Apple’s comeback could be so quick and swift, I might have opted for a more aggressive, out-of-the money fist full of calls. As it stands now, I still have dry powder reserved for Apple if sellers manage to take the stock down again after earnings.

Be careful out there!

Full disclosure: long AAPL call spread