(This is an excerpt from an article I originally published on Seeking Alpha on April 3, 2012. Click here to read the entire piece.)

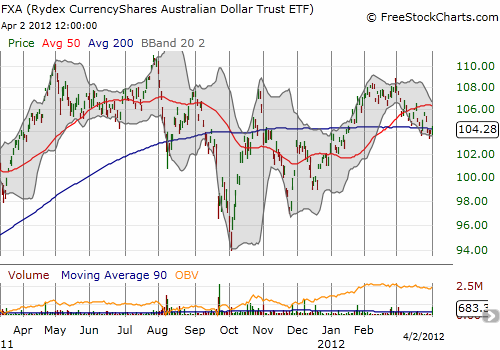

In its latest statement on monetary policy, the Reserve Bank of Australia (RBA) dropped more hints that it is likely biased toward further easing of monetary policy and has a preference for a lower Australian dollar. The RBA does not yet have the data to support a rate cut, but the wording of this statement indicates to me that it expects to soon see such data:

{snip}

Economic growth is not quite meeting expectations (“the balance of recent information suggests that output growth was somewhat below trend over the year”) in an environment in which the housing market remains “soft,” and the RBA expects the world economy to grow below trend. This combination suggests that the risks to inflation are weighted to the downside. {snip}

Finally, the RBA included two reminders that it thinks the currency is likely stronger than it should be. {snip}

On balance, I interpret the RBA’s smoke signals to indicate that it will take a surprisingly strong economic and inflation report to prevent the RBA from easing within the next meeting or two. {snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on April 3, 2012. Click here to read the entire piece.)

Full disclosure: no positions