(This is an excerpt from an article I originally published on Seeking Alpha on March 19, 2012. Click here to read the entire piece.)

In November, 2010, Nassim Taleb (Mr. Black Swan) broke a long-standing media blackout to talk on CNBC about his distress over quantitative easing Part two (QE2). At the time, Taleb concluded that the risks of QE2 were not worth the uncertain benefits. Given the Federal Reserve’s objective of driving consumers and investors out of cash and into stocks and consumption, I found it curiously ironic that Taleb returned to CNBC for the first time since that 2010 visit and lamented the following:

“I own stocks. Why? Because I don’t trust Treasury bonds…{snip}…”

Put a mark in the win column for the Federal Reserve.

{snip}…I was even MORE startled to hear Taleb mention he also owns some euros (FXE). {snip}…

{snip}

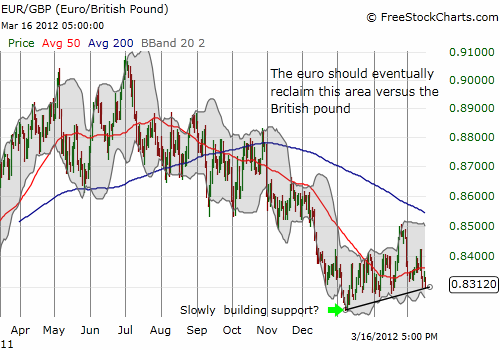

{snip} I am a staunch bear on the British pound, and I like the apparent upside on the EUR/GBP pair:

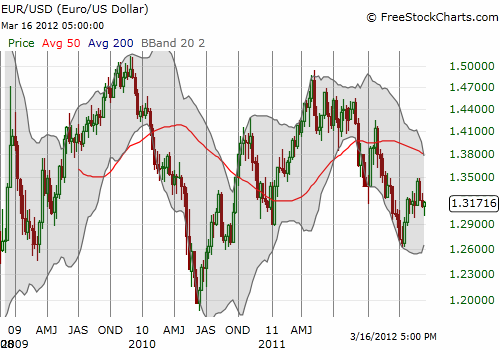

Source of charts: FreeStockCharts.com

{snip}

{snip}… Recall that last summer, Nassim Taleb joined the IMF to help the G20 understand tail risks in the global economy. I have to assume that his research has led to the conclusion that most threatening Black Swans are no longer fluttering toward the shores and hamlets of Europe.

{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on March 19, 2012. Click here to read the entire piece.)

Full disclosure: long EUR/GBP, EUR/CHF, GLD