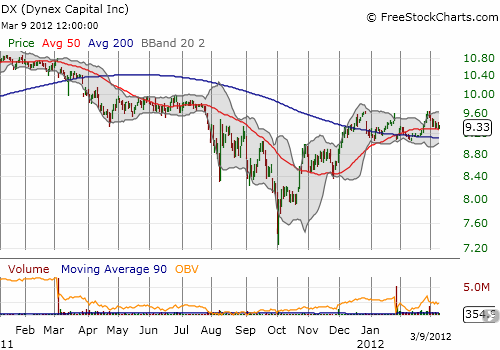

In late January, I made the case for investing in Dynex Capital (DX) as one way to bet on a recovery for housing starting that I believe will begin in earnest next year. DX had dipped at the time on news of a stock offering to raise more capital. As anticipated, DX did eventually recover all those losses although it has pulled back a bit again since late February.

Source: FreeStockCharts.com

Soon after my post, I received an interesting message from David Kowal of Kowal Communications on behalf of Vertical Capital Markets Group of Irvine, California. Vertical Capital Markets Group was founded in 2004 to underwrite, monitor, and service home loans that it purchases. Last December, Vertical launched the Vertical Capital Income Fund (VCIF) to provide retail investors the opportunity to diversify their portfolios with investments in home mortgages. VCIF is a continuously offered, diversified, closed-end management investment, also known as an “Interval fund.” Vertical buys high quality loans at a steep discount and, when necessary, works with homeowners to restructure their loan as part of their mission to keep people in their homes. From a company press release, Vertical states the following as part of its unique value proposition:

“…The company’s wide network of contacts within the banking industry allows the firm to uncover mortgage loan opportunities that other buyers might not find. As loan servicer, Vertical also has access to information not readily available to most institutional investors.”

Intrigued, I asked Kowal some follow-up questions which eventually led to an interview with Vertical’s chairman, Gus Altuzarra. Mr. Altuzarra is a 30-year veteran of the mortgage industry. I enjoyed talking with him and learned a lot more about the way Vertical operates, its investing philosophies, and the dynamics of the current housing market. I provide below an edited transcript from the interview. I encourage you to do your own additional research before deciding to invest in the fund.

— – —

Vertical Capital Markets Group sold mortgages until 2007 when the prices of loan sales dropped too much to account for the risk of the loans. For example, Vertical could make 2-3 points on a $1 million loan in the secondary market (or $20,000-30,000). The average person does not take this deal and, moreover, Vertical had to guarantee the loan. Vertical changed its model in December, 2007 and decided to raise money to make loans and keep them. The company raised money from “friends and family.” In total, Vertical has raised $27 million for its Vertical U.S. Recovery Fund I and $5 million for its Vertical U.S. Recovery Fund II.

When the market dropped starting in 2007, raising money became extremely difficult. The lack of sufficient capital held the company back. The 2010-2011 change in the definition of an “accredited investor” diminished the pool of investors further. A retail fund allows Vertical to continue growing and purchasing more discounted loans.

Vertical is able to get loans at a steep discount because the collateral (the home) has dropped in value. Across the country, homes have depreciated about 40%. Anyone planning to deliver loans into the secondary market before this big decline found themselves holding a large basket of loans that they never intended to keep. Most loan-to-value metrics became negative, forcing these players to sell. Given the low liquidity in the market, these companies also could not sell these loans all at once.

These companies cannot hire a firm to manage their portfolio of loans because their capital is (unexpectedly) tied up. The drop in property value makes the loans impaired. The companies will realize heavy losses if such loans go into foreclosure. Some of these companies bought too early in the cycle and used too much leverage. The specific motivation for a company to sell distressed loans depends on the capital position.

This situation represents Vertical’s window of opportunity. Vertical buys loans at a price where it can achieve positive equity. Buying loans at 60 cents on the dollar with a 6% coupon generates about a 10% return. The fund is over-collateralized, so foreclosure risk is manageable. Vertical looks for loans with people who have a reason to stay in the house whether for emotional reasons (like amount of time living in the home) or for financial reasons (like a large down payment) or other reasons. For those who require help, they generally face issues of affordability or the loss of hope in ever paying off the house. Vertical will lower payments through a reduction in principal and lower interest rates. This is a non-taxable event for owner-occupied homes. Vertical has made such financing accommodations for about 30% of its loan portfolio.

Investors in the Vertical Capital Income Fund receive an income stream and capital appreciation. Dividends are paid monthly and automatically re-invested. Shares are priced daily but investors can only tender their shares once a quarter. Vertical can only redeem 20% of its shares per year (5% per quarter); this can increase to 25% if the capital is available. Investors get a pro rata redemption if the limits are hit. Investors can purchase shares any day. Investors own shares in the fund and do not own the mortgages directly.

The current funds have averaged returns of 10.7%. With fees, the average returns are 7 1/2 to 8%. The Funds that include modified loans started with much higher returns. Removing leverage from the equation, Vertical’s funds likely provide similar returns to a mortgage real estate investment trust (REIT) like Dynex Capital.

The Vertical Capital Income Fund reached $2 million in funds on January 1st and can now purchase its first loan portfolio. Diversification standards for mutual funds extend the time it takes to acquire loans.

Dynex Capital is a very different financial instrument for investing in mortgages from Vertical Capital Income Fund. DX invests in mortgage-backed securities (MBSs). An MBS provides a rating and maybe some insurance. On the other hand, Vertical intimately knows the assets underlying its investments. Vertical reviews the physical house and analyzes the individual borrowers. Vertical reviews maximum loan-to-value, property types, and payment patterns.

— – —

If you want to learn more about the Vertical Income Fund I highly recommend you take the time to review Vertical’s website and the detailed information about the fund. Over the coming weeks, I intend to do my own additional review, and I anticipate investing in the fund as another alternative for investing in the recovery of the housing market.

Be careful out there!

Full disclosure: long DX