(This is an excerpt from an article I originally published on Seeking Alpha on March 7, 2012. Click here to read the entire piece.)

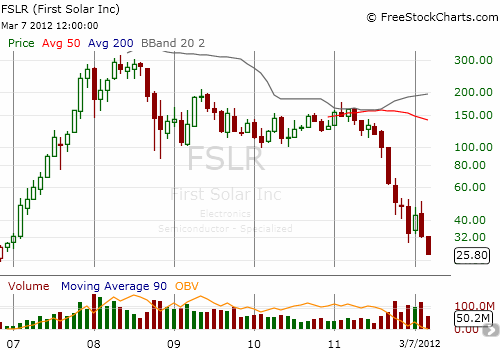

When Energy Conversion Devices (ENERQ.PK) filed for bankruptcy in mid-February, I wrote “The Solar Fun Is Done For Now.” I should have also said that the “horror show has just begun” because a horror show has unfolded since then. With the major indices still flirting with fresh 52-week highs, most solar stocks have now given up over 50% of their 2012 gains. Several stocks are suddenly sitting on losses for the year, like First Solar (FSLR).

{snip}

Source: FreeStockCharts.com

The real liquidity risk FSLR now faces got my full attention. {snip}

First Solar used to throw off bucket loads of cash and its balance sheet was the envy of the industry. Now, First Solar has only $110M in net cash…{snip}…This liquidity risk now leaves the stock extremely vulnerable to any news about operational or sales issues. {snip}

It seems at this point First Solar will need a savior to survive. {snip}

{snip}

Bottom line, if you want to continue to speculate on a revival in solar, options appear to best balance risk/reward. {snip} I continue to recommend at a bare minimum that solar investors actively protect their portfolios (I have been buying and then selling puts on FSLR). The brutal news for the industry is far from over in 2012, but the survivors should have very good business prospects in front of them. (For example, see “Using Debt-to-Equity Ratios to Identify Potential Survivors of the Solar Downturn“).

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on March 7, 2012. Click here to read the entire piece.)

Full disclosure: long FSLR shares, puts, and calls. Short FSLR puts.