(This is an excerpt from an article I originally published on Seeking Alpha on March 5, 2012. Click here to read the entire piece.)

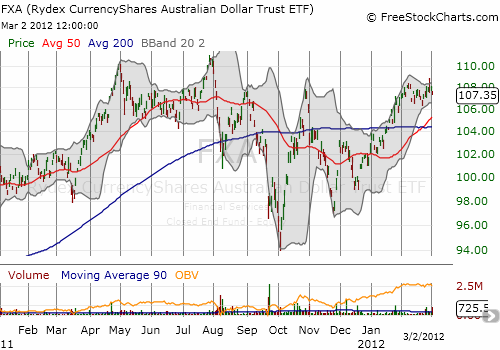

{snip}…this is a good moment to describe finally why I recently sold my long-term holdings in the Rydex CurrencyShares Australian (FXA).

{snip}

Never once have I pondered the possibility of the RBA actively intervening in currency markets to weaken its currency. {snip} I stood by the Australian dollar through the threat of a commodity crash driven by a collapse in the Chinese economy. I was even unfazed last November when the RBA joined much of the rest of the world in easing monetary policy with its first rate cuts since the financial crisis. In other words, I remained utterly convinced that Australia offered a relatively more attractive investment than the currencies and economies of other developed nations. In a world featuring on-going competitive devaluations, Australia seemed to stand uniquely above the fray. Stevens’s musings pulled THAT rug from under me. Intervention adds one risk too many for me to accept at this point. {snip}

Adding credence to the possibility of intervention, however small, was Stevens’s assessment that the Australian dollar is stronger than expected…{snip}

In the meantime, I continue to execute short-term forex trades going long the Australian dollar. {snip}

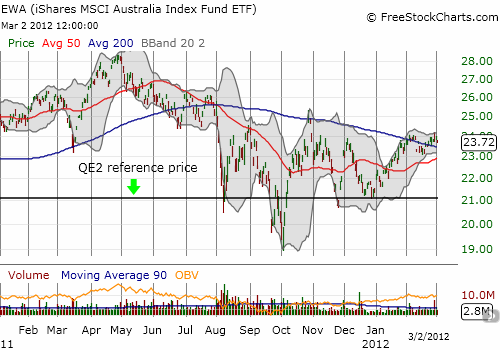

{snip} I remain interested in initiating positions in EWA whenever it references the “QE2 reference price” the still forms the basis of purchases as part of my commodity crash playbook {snip}

Source for all charts: FreeStockCharts.com

{snip}

My love affair with the Australian dollar has ended, but I remain actively interested in investing in Australia. As long as emerging economies are generally increasing their consumption of commodities, I think it is much more productive to stay vigilant for buying opportunities than to try betting against our friends down under.

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on March 5, 2012. Click here to read the entire piece.)

Full disclosure: long SDS