(This is an excerpt from an article I originally published on Seeking Alpha on February 21, 2012. Click here to read the entire piece.)

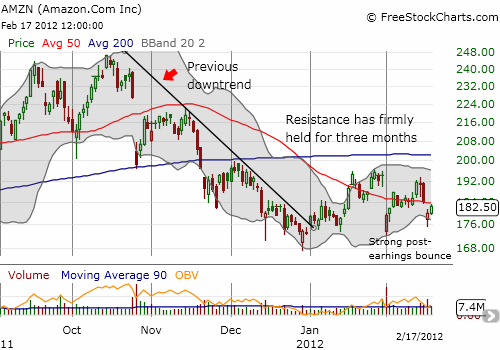

Congratulations to everyone who took on the post-earnings trade on Amazon.com (AMZN). Hopefully, you have locked in your profits by now given the 2-week timeframe for the trade. It is now time to revert to a bearish bias on the stock. {snip} Note well that I concluded in the AMZN post-earnings analysis that the risk/reward for shorting AMZN is best AFTER AMZN has closed below the low (~$172) from the first post-earnings day. Until then, I recommend staying on the sidelines and observing. If AMZN manages to close above its 200DMA (now around $203), I will reassess my bearishness.

Source: FreeStockCharts.com

The post-earnings trade was an even bigger success than I could have expected. I am posting here a summary of my execution and the rationale as potential notes and reference for future rounds of trades. {snip}

Forcing myself to write all this out helped me identify three things:

- I probably traded far too much even though it all worked out extremely well, even after commissions. The call spread would have expired nearly flat with my original cost. Next time, I may not be so fortunate. I need to work on sticking to the script and exiting cleanly.

- Having said that, I learned that weekly options can provide extremely effective hedging and speculative trading at relatively low cost.

- AMZN continues to be an extremely volatile stock day-to-day and intra-day. The options market seems to be under-pricing the risks. I am biased to continue playing highly leverage options on AMZN as long as this buyer’s advantage persists.

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on February 21, 2012. Click here to read the entire piece.)

Full disclosure: no positions