(This is an excerpt from an article I originally published on Seeking Alpha on March 1, 2012. Click here to read the entire piece.)

On Wednesday, February 29, gold plunged 5.0% and silver plunged 5.7% presumably because traders had incorrectly bet that Ben Bernanke would use the occasion of his semi-annual Congressional testimony to either announce or telegraph a third round of quantitative easing (QE3). Indeed, Bloomberg reported the following:

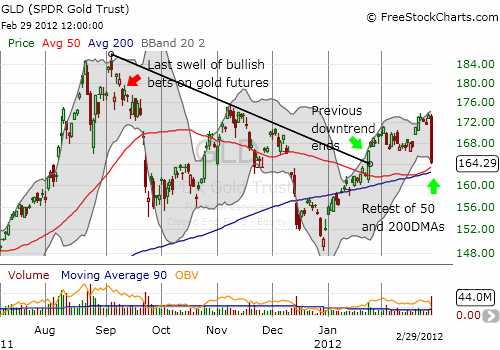

“In the week ended Feb. 21, hedge funds and money managers boosted bullish bets on gold futures by 9.9 percent to 179,132 contracts, the highest since Sept. 13, the latest government data showed on Feb. 24.”

It is likely not a coincidence that the last time big traders crowded into the gold trade, it also preceded a large drop in gold and silver.

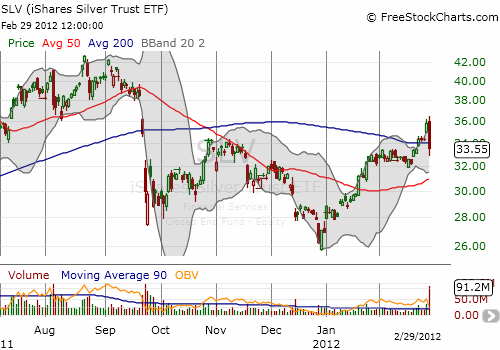

Notice that in the charts of both GLD and SLV (using the ETFs as sufficient proxies for the trends on spot prices), the large one-day sell-offs have nearly invalidated recent breakouts. {snip}

{snip}…to the extent that strength in the U.S. dollar equates to lower gold and silver prices, the dollar’s potential to rebound on a brief relief rally suggests that gold and silver have a little more downside.

{snip}…if you so dare, you can buy a little Proshares Ultra Short Silver (ZSL) as a small hedge or a pure speculative trade as teh fund attempts an impressive bounce from all-time lows (technicians will notice the bullish engulfing pattern).

Source for all charts: FreeStockCharts.com

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on March 1, 2012. Click here to read the entire piece.)

Full disclosure: long GLD, SLV, GG, GDX, PAAS