(This is an excerpt from an article I originally published on Seeking Alpha on March 4, 2012. Click here to read the entire piece.)

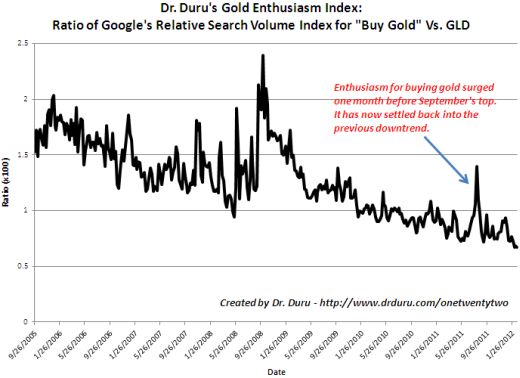

Right after I last updated the gold enthusiasm index last July, gold went near parabolic and peaked in about two months. In that post, I wrote that enthusiasm for gold continued to wane, implying from a contrarian view that gold was not caught in a bubble and certainly had not peaked. If I had updated the “gold enthusiasm index” during the run-up, I would have finally observed a sudden ignition of gold enthusiasm. That surge would have perhaps flagged a potential topping pattern (even if temporary given the strong longer-term fundamentals for gold). As it is, I am reporting many months after the fact.

{snip}

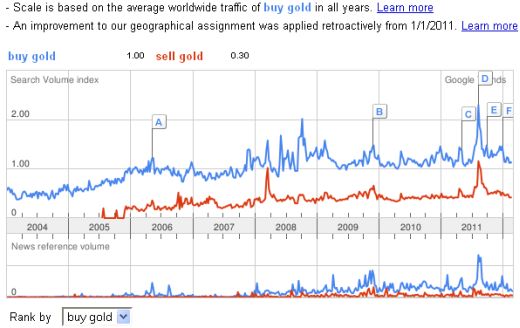

Source: Google Trends

{snip}

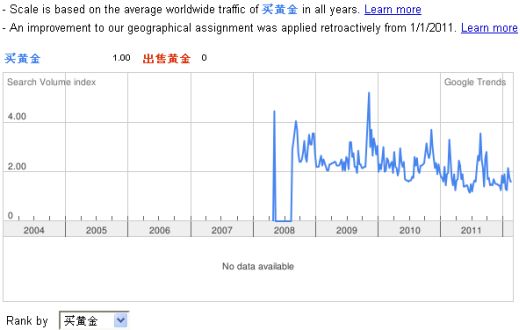

Since the Chinese are large buyers of gold, I also looked at Google searches in Chinese. This is a poor proxy for Chinese interest given Google is not the primary search engine, but I have to use it for consistency with the rest of my metrics. I used Google translate to convert “buy gold” into 买黄金 and “sell gold” into 出售黄金. {snip}

Source: Google trends

As a reminder, the gold enthusiasm index is a stylized metric that is simply the ratio of the relative Google search volume index for “buy gold” and the price of SPDR Gold Trust (GLD). {snip}

Source: Google trends and FreeStockCharts.com

I gathered two key lessons from this exercise: 1) Check the gold enthusiasm index more frequently, especially during dramatic price swings in gold, and 2) consider the full context surrounding changes in the index as relative changes seem to be much more important than absolute ones.

It is entirely possible that the spike in “sell gold” was the more important signal. {snip}

To be clear, I still believe the fundamentals for gold remain firmly in place. {snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on March 4, 2012. Click here to read the entire piece.)

Full disclosure: long GLD, GG, GDX