Something happened along the way to infinity for Apple Inc. (AAPL): a big bearish engulfing pattern.

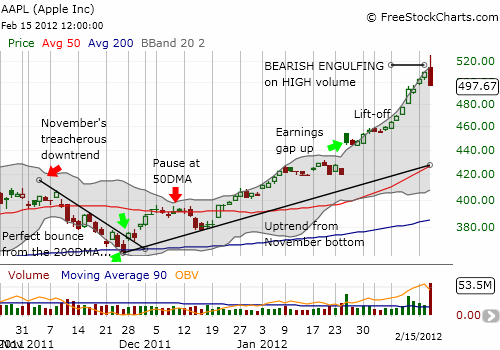

A bearish engulfing pattern occurs when a stock opens above the close of the previous trading day and closes below the close of the previous trading day, especially in the midst of an uptrend. The larger the range of the selling day, the more bearish the signal as it shows more exhaustion of buying. The signal is even more bearish if the selling occurs on high volume after a very strong upward move. Even more bearish if the fall occurs from a major high. Apple’s stock now has all these characteristics. The chart below shows the bearish engulfing pattern in the context of the previous bullish bounce off the November lows and the 200-day moving average (DMA). Note that AAPL could fill its last post-earnings gap up and still maintain its primary uptrend from the November lows.

Source: FreeStockCharts.com

The most worrisome part of the technical set-up is the tremendous volume. Since November 20, 2008, there have only been seven days with larger volume. That statistic includes the flash crash on May 7, 2010. Today’s trading volume is the highest single-day trading volume for the last 13 months (used trading volume data from Yahoo!Finance). This kind of volume under the current conditions has all the look and feel of a climactic top.

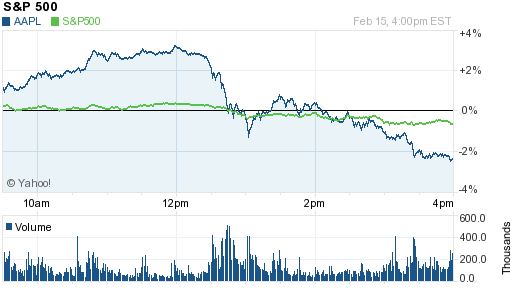

News has swirled about the seizure of iPads from store shelves in China in connection with a trademark lawsuit. I doubt this explains the heavy sell-off in Apple’s stock, especially given the strong buying to start the morning that took AAPL as high as $525. AAPL fell intra-day just as the general stock market fell. Compare the intra-day charts of AAPL and the S&P 500 below; I did not use the NASDAQ or QQQs since they are heavily concentrated with tech stocks. Note also the distinct surge in volume as Apple fell from its all-time highs.

Source: Yahoo!Finance

Given the parallels, one could easily argue the more important implication of Apple’s rapid fall from all-time highs is that it could be confirming a top for the stock market.

Despite the ominous technical patterns, I am not a bit interested in shorting Apple here. Instead, I am eagerly looking for a re-entry point. This topping pattern tells me to take a deep breath, pause, and be patient. Apple can of course overcome the topping pattern, but it will like require time, the shake-out of weak hands, exhaustion of selling, AND THEN finally the re-ignition of buying interest and power. Tops are usually a process, not an event.

In the meantime, I will be watching the stock’s behavior at important points of support. Unfortunately, given the near straight-line nature of the recent run-up, AAPL’s stock has little natural support until the minor consolidation immediately following earnings last month.

Be careful out there!

Full disclosure: long SDS shares and calls