(This is an excerpt from an article I originally published on Seeking Alpha on January 26, 2012. Click here to read the entire piece.)

Last week, I wrote about the opportunities arising from the crash in natural gas prices. On the morning of January 24, CSX Corporation, a railroad company, provided timely commentary on natural gas during its earnings conference call. In the transcript provided by Seeking Alpha, CSX’s CEO made the following claim (emphasis mine):

“…gas prices, in our view, are nearing the end of where the bottom of the gas market is…you’re seeing the rig count start to do several things: One, they’re changing. They’re actually going down, particularly in the Marcellus Shale. Two, a lot of the drill rigging counts are moving from Eastern Pennsylvania over to Western Pennsylvania to go for the Utica oil reserves. So we see a stabilizing in the natural gas prices.”

{snip}

I am probably a little early in adding to my SJT position, but at a 9.4% yield, I am willing to take on the extra risk. I have not yet decided whether to allocate a third (and final) tranche to this position.

{snip}

Low natural gas prices have also been a boon to chemical companies. CSX indicated that these low prices have made the U.S. chemical industry “very competitive on a worldwide basis.”

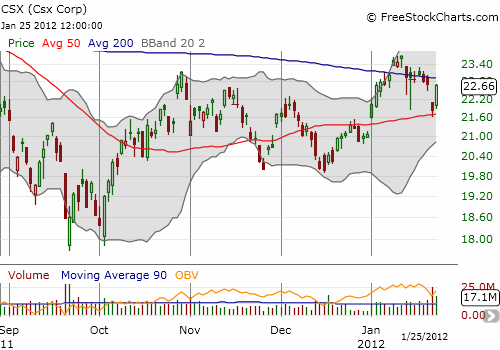

The stock market responded to CSX’s earnings report by sending the stock 3.7% lower. The very next day, CSX gained it almost all back.

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on January 26, 2012. Click here to read the entire piece.)

Full disclosure: long SJT