(T2108 measures the percentage of stocks trading above their respective 40-day moving averages [DMAs]. To learn more about it, see my T2108 Resource Page. You can follow real-time T2108 commentary on twitter using the #T2108 hashtag. T2108-related trades and other trades are posted on twitter using the #120trade hashtag)

T2108 Status: 83% (overbought day #11)

VIX Status: 20.9

General (Short-term) Trading Call: Close more bullish positions, begin/expand bearish positions

Reference Charts (click for view of last 6 months from Stockcharts.com):

S&P 500 or SPY

SDS (ProShares UltraShort S&P500)

U.S. Dollar Index (volatility index)

VIX (volatility index)

VXX (iPath S&P 500 VIX Short-Term Futures ETN)

EWG (iShares MSCI Germany Index Fund)

Commentary

“The stock market is overbought with T2108, the percentage of stocks trading above their respective 40-day moving averages (DMAs), at a five-month high at 79%. Given current momentum, I expect the stock market to cling stubbornly to overbought levels. Such behavior has been common since the bounce from March, 2009 lows. I even expect T2108 to make a rare appearance at 90% before this latest push experiences a significant setback…When the stock market was at a 3-month overbought high in February, I marveled at the market’s pace of gains…This is the kind of momentum the market may re-establish on its way to the next presumed resistance level at 1440 given Federal Reserve Chairman Ben Bernanke waved the green flag again at this week’s first ever press conference on monetary policy.”

This is what I posted on April 30, 2011 in “The Fed-Inspired S&P 500 Likely to Remain Overbought As Index Reaches for Previous Uptrend.” The day before, the S&P 500 closed at 1363.61. The following Monday, May 2, the S&P 500 climbed as high as 1370.58. In 6 weeks, the index lost 7%, made a valiant rebound, and then succumbed to the huge summer swoon we now know so well (and bears fondly remember).

I reviewed this post to remind myself of my thinking just as the stock market was printing a major top. Although I was anticipating some kind of top at some point soon, I had clearly become seduced by the show of buying force in the stock market up until that point. Momentum is a powerful drug.

The prospect of Federal Reserve money-printing (or the equivalent jawboning) is another powerful drug. At that time, QE2 was still working its magic, and the Federal Reserve was still selling its benefits.

Following the logic of breakout technicals, 3-year highs confirmed a major bull run for the stock market. This meant that every single overbought period over this time was merely a rest stop before a resumption of the rally. Traders could be excused for ignoring T2108 since it was a period during which selling was for sissies and for suckers who wallow in regret.

Roll the tape forward and T2108 is now on its 11th day in overbought territory, covering every single trading day of 2011 to-date. Excited chatter is spreading over the prospect of more support from the Federal Reserve in the form of another round of quantitative easing (QE3) – see “Talk Of QE3 Increases As The Dollar Rises – Time To Reposition.” The S&P 500 has mainly dribbled its way straight up since the monster one-day rally on December 20 that separated the market from what looked like a near certain return to oversold territory. The air has a familiar bullish scent to it as the S&P 500 breaks out above its 200DMA, prints 6-month highs, and effectively erases ALL its losses from the summer swoon. Panicked traders and investors who sold at those depths are now full of regret, eager and anxious to get back in before the market leaves them behind for good.

Just as last year (and in 2010 and 2009), it is easy to get seduced by the momentum and the non-stop show of buying in the stock market (or perhaps the lack of interest in sustaining selling)…particularly when it has the backing and endorsement of the resources of the Fed.

In other words, all the psychological dominoes are lined up to tip the market into a major rally. The question confronting followers of T2108 is the following: “Is this overbought period like the temporary rest stops between 2009 and last winter or is it another red flag ahead of a significant sell-off?” Oh, the suspense! The uncomfortable answer is we will not know for sure until it is done.

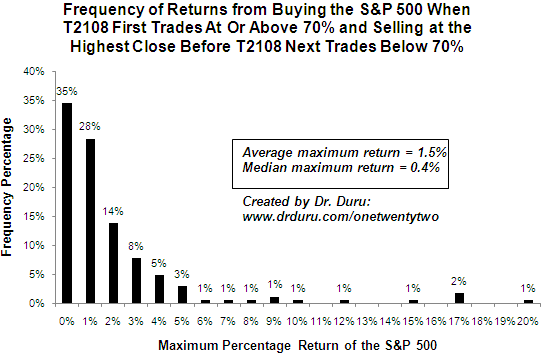

If this is a temporary rest stop, the overbought period could last a lot longer. At 11 days, T2108 is beyond both the median (4) and average (9) durations for an overbought period. For perspective, only 19% of all overbought periods since 1986 have lasted longer than 14 trading days. Only 7% of these overbought periods have lasted longer than 24 trading days. If you have not yet read my updated analysis of overbought periods, now is the time to read it: click here. In this analysis, I look at overbought periods from many different perspectives, including the maximum return you can expect if you had the magical fingers to sell at the exact top of the overbought period (or your maximum loss if you were unfortunate enough to get stopped out at the very top). 85% of the time, you will get less than 4% from such magic. 90% of the time, you will get less than 5%. The S&P 500 has now gained 4%. If you sold now, there is roughly an 85% chance you nailed the top for now (and do you really want to push your luck further with these odds?). Here is the distribution chart:

Again, I highly recommend you review the entire analysis. That analysis includes a scatter plot showing that overbought periods typically do not experience outsized returns until they pass about 25 days in duration.

Anyway, note the juicy returns in the “tail” of the above distribution. They warn us that while extremely unlikely, the chance of a very large rally is NOT zero. So what can a trader do “just in case” something unusual happens and the overbought periods turns into a monster rally? Buy out of the money calls. Most likely, these calls will quickly lose value and/or expire worthless. So, a trader should spend much less on these calls then s/he anticipates to gain from the bearish T2108 position. However, if the overbought period ramps, these calls will appreciate quickly and provide enough profits to allow you to continue patiently waiting out the overbought period. The losses in the bearish T2108 position must increase linearly while the calls increase exponentially (toward their strike price). The target selling point will depend on the given technical conditions. Use the charts in the overbought analysis to determine likely target points.

In the meantime, I continue to wait out the suspense. Assuming the market moves higher again by the end of this week, I will soon significantly expand my bearish T2108 positioning. Stay tuned or watch for it in my twitter feed using the #120trade and/or #T2108 hashtag.

Finally, after writing this T2108 Update, I have realized that I do not have trading rules for overbought periods that are as formal as my trading rules for oversold periods. I will work on this gap in the coming weeks or months.

(On a sidenote, note well that I continue to look for buying opportunities as they occur. “Buy the dips” remains the motto for special cases such as commodities, insider stock purchases, and homebuilders. Continue to monitor my posts for these trades).

Charts below are the latest snapshots of T2108 (and the S&P 500)

Refresh browser if the charts are the same as the last T2108 update.

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Weekly T2108

*All charts created using freestockcharts.com unless otherwise stated

Related links:

The T2108 Resource Page

Expanded daily chart of T2108 versus the S&P 500

Expanded weekly chart of T2108

Be careful out there!

Full disclosure: long SDS; long VXX calls and puts

First, I love your analysis and it is one of the first things I read each day. I implemented your linear losses/exponential upside on the remote possibility of a market Breakout with Feb-12 puts at 17 and 16 and calls at 19 on SDS. The 17 puts were already in the money when the 16 puts and 19 calls were added. Your thoughts?

Regards,

Jeff Jage

Interesting! I was thinking something more like SDS shares and SSO calls, but your approach will work just as well IF the market finally makes a decisive move. The problem right now is that volatility is falling off and the market is meandering its way upward. Neither are good for options plays. I would prefer exposure to options on just one side of the trade (the SSO calls).

Since you have two strikes of puts, you may do well to sell the 17 puts if the market is kind enough to extend you enough profits to pay for the other options. That way, you can coast the rest of the way on the houses money. Good luck and thanks for checking in!

I hope to write more this weekend on strategies and rules.