This is an excerpt from an article I originally published on Seeking Alpha on January 12, 2012. Click here to read the entire piece.)

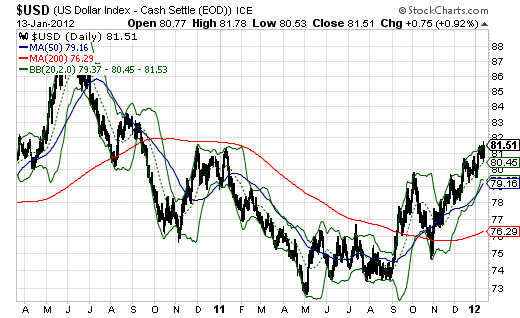

Mainly thanks to a plunging euro (FXE), the U.S. dollar index (UUP) now sits at 52-weeks highs set in January, 2011. When the Federal Reserve telegraphed its second round of quantitative easing (QE2) at the end of August, 2010, the dollar index was only 2.4% higher than where it is now. Moreover, the final months of 2011 featured fresh rounds of monetary easing around the globe. Under these circumstances, I think it is no accident that talk of QE3 is getting louder.

Source: StockCharts.com

On Friday, January 13, CNBC’s Steve Liesman discussed the accumulation of evidence supporting QE3. Two Federal Reserve board members have recently gone on record in support of additional monetary accommodation. New member John Williams stated that the forecast for sustained unemployment argues for more stimulus. Sandra Pianalto claimed that economic models suggest the Federal Reserve should be more accommodating.

Liesman reports that doubts are growing within the Federal Reserve about the economic data:

{snip}

Liesman did not discuss the steady rise in the U.S. dollar as another factor, but at a minimum, the dollar’s levels certainly give the Federal Reserve more room to the downside to implement value-destroying monetary policies. The higher the dollar goes, the more ready the Fed will be to ease. The moment the Federal Reserve telegraphs QE3, I am going to make several changes to my positioning, especially in foreign exchange (forex):

{snip}

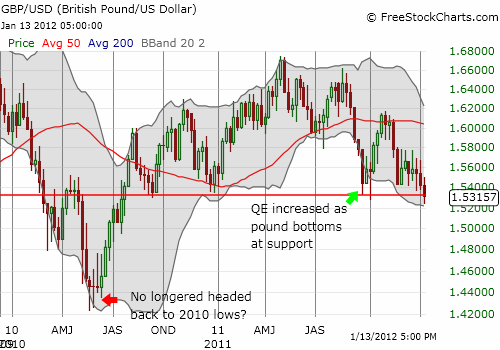

Source: FreeStockCharts.com

{snip}

Be careful out there!

This is an excerpt from an article I originally published on Seeking Alpha on January 12, 2012. Click here to read the entire piece.)

Full disclosure: long GLD, SLV, GG, FXA