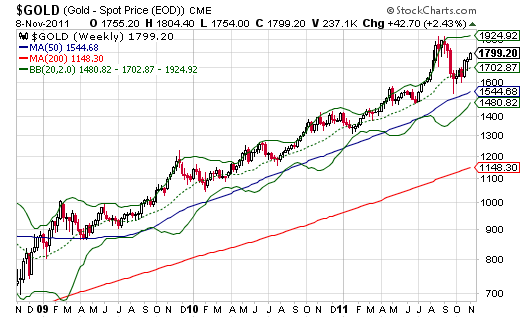

The gold bubble continues to “unpop.” In fact, as it turns out, the recent dip in gold was just a pullback to trend. This three-year weekly chart puts some perspective on the recent pullback.

Source: stockcharts.com

While gold skeptics were declaring that gold’s “bubble” had popped again, the Chinese were busy scooping up the yellow metal at the lower prices at a furious pace. From the Financial Times:

“Chinese gold imports from Hong Kong, a proxy for the country’s overall overseas buying, leapt to a record high in September, when monthly purchases matched almost half that for the whole of 2010…Data from the Hong Kong government showed that China imported a record 56.9 metric tons in September, a sixfold increase from 2010.”

The Chinese apparently know a bargain when they see one. I estimated that the first buying opportunity for gold would be a 10% correction, and gold just barely dropped that far from recent highs. The Financial Times cites several drivers of strong Chinese demand:

- Inflation hedging

- Limited alternative investment options

- Rising incomes

- Jewelry buying and gift-giving – demand is up 13% year-over-year

Moreover, “The last two months of this year are likely to see China’s gold imports surge further ahead of Chinese New Year, supporting gold prices…”

Throw in continued money-printing to manipulate currency values lower, and I find plenty of reasons to continue owning and holding gold for the foreseeable future.

Be careful out there!

Full disclosure: long GLD