(This is an excerpt from an article I originally published on Seeking Alpha. Click here to read the entire piece.)

Nouriel Roubini thinks the S&P downgrade could help lock the U.S. into a recession and Christina Romer wants to “swing for the fences” and respond with a massive jobs bill – Bloomberg Video: “Roubini, Rosner, Bianco and Romer Discuss U.S. Downgrade”

China is … fuming – {snip} See: “China tells U.S. ‘good old days’ of borrowing are over.”

Euro-region central bank governors are scrambling to make sure the S&P downgrade does not make the European sovereign debt situation even worse: “Euro-Area Central Banks to Hold Crisis Call”

Finally, Paul Krugman thinks ratings agencies are irrelevant:

{snip}

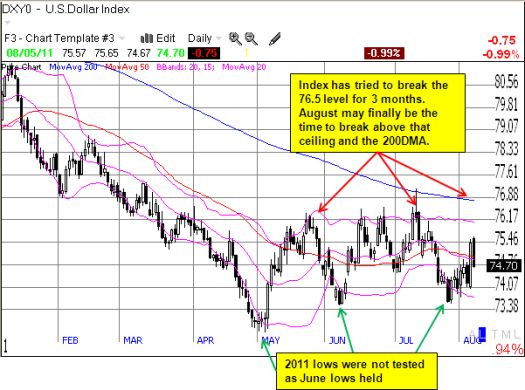

Arguably, the news of the downgrade comes as little surprise, but it does present an interesting scenario for a continuation of the dollar’s bounce from its July lows…

{snip}

*Chart created using TeleChart

{snip}

I have never bothered to review a ratings report, but I could not help myself this time around…{snip}… What stood out the most to me was the extensive commentary about the vicious political deadlock in America. Standard and Poor’s fears that America’s national politicians will be unable to agree on anything substantial or make any progress on the deals needed to resolve long-term fiscal (or economic) problems…

{snip}

S&P even felt compelled to assume that the Bush tax cuts will not expire at the end of 2012 as currently planned. This is a large and important assumption because it further deepens budget deficits going out into future years and worsens the fiscal outlook:

{snip}

The end of a relief rally for the dollar will likely bring … longer-term realities back into full view for financial markets.

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha. Click here to read the entire piece.)

Full disclosure: net long the U.S. dollar, long FXA, GLD, GG, SLV, PAAS, TBT