(This is an excerpt from an article I originally published on Seeking Alpha. Click here to read the entire piece.)

In July, I used ideas from Jeremy Grantham to lay out a case for taking advantage of a coming “commodities crash” to invest in and prepare for a future resource-constrained world: “Preparing for Profits in a Resource-Constrained World” and “Profiting from Physical Assets in a Resource-Constrained World – Rules and Picks“. {snip} …I am using the effective launch of QE2 (second round of quantitative easing) at the end of August as a benchmark for triggering purchases…

{snip}

Thanks to a 17% drop after reporting earnings Thursday morning, Alpha Natural Resources (ANR) has the ignominious distinction of being one of the first to punch through QE2 support.

*Chart created using TeleChart

{snip}

Certainly the complete collapse in the stocks of steel companies suggests a dismal near-term outlook for ANR (I will write more on the collapse in steel stocks later…) {snip} …

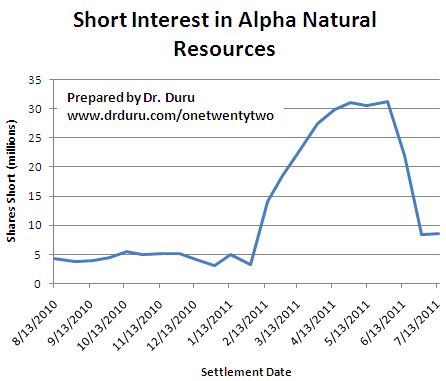

Shorts have hounded ANR…

{snip}

Source: NASDAQ.com

{snip}

Brazil’s economy gets a large contribution from the production and export of commodities, making it a prime candidate for the commodities crash playbook. EWZ, the iShares MSCI Brazil Index Fund ETF, triggered TWO different buy signals last week. EWZ erased all its post-QE2 gains last Wednesday (Aug 3), but I bought the next day when I noticed EWZ hit my rule for buying EWZ when it reaches a 20% correction…

{snip}

*All stock charts created using TeleChart

{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha. Click here to read the entire piece.)

Full disclosure: long EWZ, ANR