(This is an excerpt from an article I originally published on Seeking Alpha. Click here to read the entire piece.)

I have not updated my “sentiment” analysis on gold in nine months…{snip}…I think this is a great time to take a fresh look.

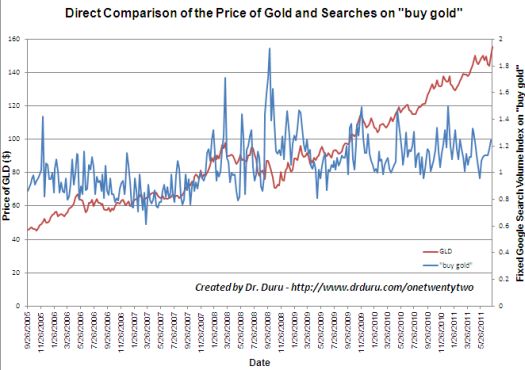

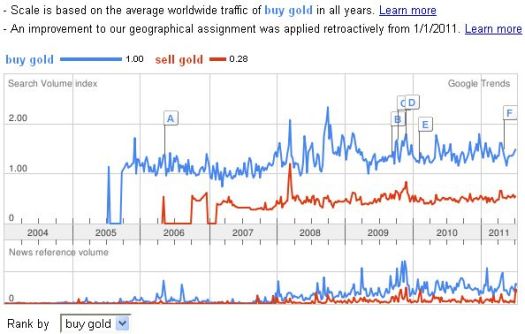

{snip}…I use Google Trends on the terms “buy gold” and “sell gold” to see whether any particular anomalies have occurred. This view has interested me mainly because two anomalies appeared in 2008 that seemed to flag large changes in the price of gold. In early 2008, searches using “buy gold” and “sell gold” spiked as gold surged toward $1000. That turned into a peak that lasted for another year. After the financial world collapsed in September, 2008, searches on “sell gold” remained flat but “buy gold” surged again. These searches spiked around October 10, 2008 and gold printed a secondary peak…

{snip}

…In other words, anomalies in searches on either term work as strong indicators of temporary highs in gold prices.

Source: Google Trends

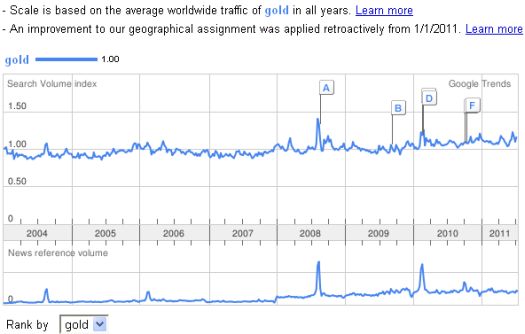

Note that searches on just “gold” are not quite as informative as “buy gold” or “sell gold” given the lack of spikes in 2009 and 2011 and a false signal in early 2010.

Source: Google Trends

{snip}

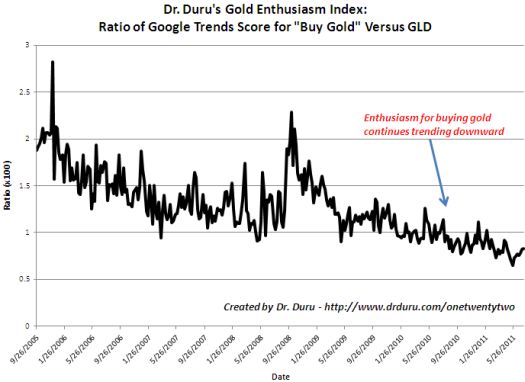

While these search trends may be useful for short-term trades in gold, it is difficult to get an overall picture of what this all might mean for a longer trend without creating a ratio…{snip}…I divide the fixed search volume index on “buy gold” by the price of the SPDR Gold Trust (GLD) to create a “Gold Enthusiasm Index.”..{snip}…On a relative basis, enthusiasm for gold continues to wane…

{snip}

{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha. Click here to read the entire piece.)

Full disclosure: long GLD, GG