(This is an excerpt from an article I published on Seeking Alpha. Click here to read the entire piece.)

{snip}

Now that May, 2011 has closed down 1.4%, it seems like a good time to take yet another perspective on May’s legendary selling. This time I wondered whether May’s performance says anything about trading for the summer. I was quite surprised to discover that the summer tends to be a profitable time to trade, although it comes with high risks.

…I graphed three charts of performance (charts posted below but explained in more detail in the Seeking Alpha article).

{snip}

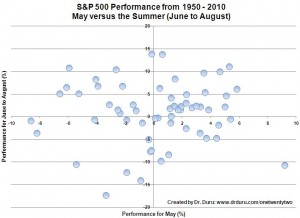

The chart of the S&P 500 in May versus the summer, June to August demonstrates the following:

- The summer produces positive returns 60.7% of the time.

- After May produces negative returns, the summer produces positive returns 54% of the time.

- After May produces positive returns, the summer produces positive returns 66% of the time.

Click for larger view:

{snip}

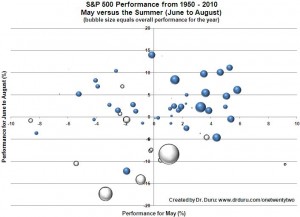

I next transformed the above chart into a bubble chart where the width of the bubble represents the S&P 500’s performance over the entire year…{snip}…The white bubbles represent negative annual performance.

Click for larger view:

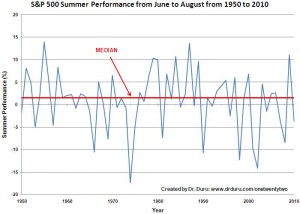

{snip}…while the median summer return since 1950 has been 1.6%, the past 21 years have been heavily skewed toward large down summers…Note that eleven of these twenty-one years actually produced positive returns…{snip}

Click for larger view:

{snip}

For more “fun with numbers” see my last analysis of the post Labor Day trade and trading at the beginning of the year.

Be careful out there!

(This is an excerpt from an article I published on Seeking Alpha. Click here to read the entire piece.)

Full disclosure: long SSO puts