(This is an excerpt from an article I published on Seeking Alpha. Click here to read the entire piece.)

As I feared would eventually happen, LPS sliced right through support and made fresh two-year lows. On Tuesday, LPS closed down 3.6% on a third straight day of heavy selling volume.

*Chart created using TeleChart:

Put activity remains strong on LPS…{snip}…the open interest on Monday expanded to match Friday’s volume on the Sept 25 puts…{snip}…Tuesday’s selling attracted more speculators as seen by the increase in put activity in the front-month (June) puts. 4474 puts traded across the June 20, 22.5, 24, and 25 strikes versus open interest of only 2208.

{snip}

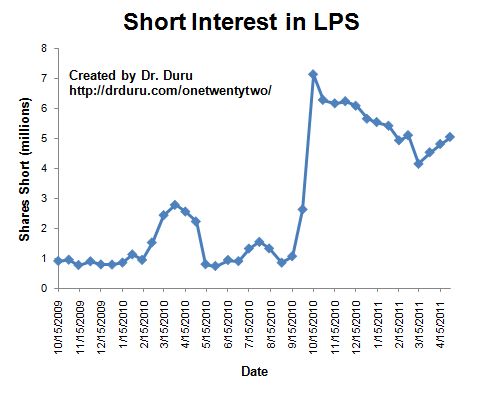

While total short interest has yet to reach the peak from October’s surge, shorts have steadily increased over the last three weeks of available data. Shorts are also 6.9% of LPS’s total float.

Source: NASDAQ.com

Cody Willard is emphatic in his explanation of the short perspective on LPS by calling LPS one of his top short ideas of the year; he even added to his position with shares and puts on Monday…

{snip}

Be careful out there!

(This is an excerpt from an article I published on Seeking Alpha. Click here to read the entire piece.)

Full disclosure: net short LPS