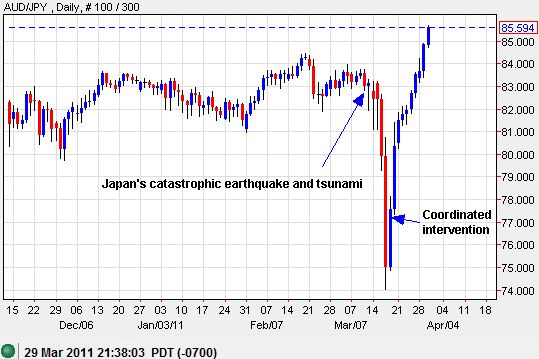

It appears that coordinated currency intervention has accomplished what unilateral intervention could not – initiate a sustained weakening in the Japanese yen.

When the Bank of Japan promised “powerful monetary easing” I quipped:

The wordsmiths were working overtime. The BoJ clearly wants to fire as strong a warning as possible to those who insist on buying yen. Choosing the adjective “powerful” to describe a monetary action is just one inspired moment short of “shocking and awesome” monetary easing.

I was not only mindful of the poor record of government-sponsored currency interventions (most recently the Bank of Japan’s failed intervention last September and the Swiss National Bank’s vault full of euros with nothing to show for it), but also observing the strong trend in the Japanese yen to keep getting stronger despite all sorts of reasons for the yen to be much weaker. With the Australian dollar and the euro now above pre-quake levels against the yen, and the U.S. dollar and the British pound almost there, it seems the Japanese monetary authorities may finally get their wish for sustained weakness in the currency. Reuters is also reporting that yen repatriation flows should be much more limited going forward than expected. The article also claims that Japanese firms now have enough funds for rebuilding. However, to the extent materials need to be imported, yen weakness could become a net cost, rather than a benefit for these rebuilders.

The Australian dollar’s recent surge against the yen dramatically demonstrates the yen’s new weakness (the Australian dollar remains by favorite currency):

Source: dailyfx.com charts

The yen’s recent weakness has helped stem the dollar’s recent breakdown from support, but the dollar index is now retesting the former support line as resistance. I am guessing traders are watching very closely how the index responds to this retest.

*Chart created using TeleChart:

Be careful out there!

Full disclosure: long FXA