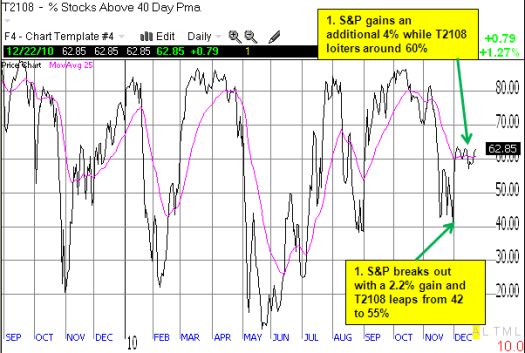

I have seen and heard several headlines pronouncing that the market is overbought, extremely overbought even. Yet, my favorite oversold/overbought indicator, T2108, the percentage of stocks trading above their respective 40-day moving averages (DMAs), has calmly churned around 60% for almost the entire month of December. The market is typically considered overbought after T2108 crosses the 70% threshold.

The S&P 500 has slowly but surely gained 6.6% so far this month. The gains have been so slow and so steady that it hardly even feels like a rally. Instead, it feels like the market is sluggish and weary – a true stealth rally. December’s move fits the script I laid out in late November when I discussed the likely implications of the market breaking out (up or down) of its short trading range:

“So, it appears that the current technical levels have multiple levels of significance. If the holiday season brings the same light volume as it did last year, I will place my odds in favor of the market floating ever higher to fresh 52-week highs. Given such a move would finally erase the imprint of 2008′s worst losses, it could get bulls salivating after fresh all-time highs for the index.”

Analysts are now projecting 10-20% gains next year with Goldman Sachs leading the way with a 1450 price target on the S&P 500 – not quite fresh all-time highs, but getting close enough. A recent Reuters poll confirms the growing bullishness amongst institutional investors. In “Investors enter 2011 in bullish mood”, Reuters found “…55 leading investment houses in the United States, Europe ex UK, Japan and Britain…holding 54.1 percent of a typical mixed-asset portfolio in stocks in December. That was up from 53.2 percent in November and the highest since 55.4 percent in February.” Moreover, U.S. money managers have boosted equity holdings and reduced cash to levels last seen in about a year or more. CNBC notes in “Now That Everyone Likes Stocks Again, Is It Time to Sell?” that “equity funds took in $3 billion over the most recent six-day period, showing growth for only the first time since April.” The stock market hit 52-week highs in April before launching a sharp correction. So all these sentiment and behavioral indicators seem to point to giddy levels of optimism.

Normally, I would also get alarmed by now. Yet, with T2108 indicating that stocks as a group are meandering, not rocketing, upward, I am more inclined to think of this period as a calm before potential fireworks. That is, at some point, the impatience of those missing this rally will eventually ignite a sharper push upward before any correction finally develops. (The latest push into equity funds has not yet changed the on-going three-year trend of withdrawals by individual investors). If we get a correction before hitting overbought levels, I strongly suspect it will be treated as a golden buying opportunity – making for shallow downward pressure.

*All charts created using TeleChart:

There is at least one interesting byline unfolding in the currency markets. The Swiss franc has been surging against all the major currencies lately. In particular, the franc is either at or printing fresh all-time highs against the euro, pound, and the U.S. dollar. We last saw this kind of action at the height of the financial crisis in 2008. Now, the franc is surging as global stock markets continue their recoveries. Moreover, commodities are not crashing, rather they continue to set fresh multi-year highs (the Australian dollar just punched through parity against the U.S. dollar for the second time ever). So, it does not look like the rush to the franc is a run for safety from comprehensive economic peril (not yet anyway). Instead, I suspect the franc is being seen as one of the last “safehouses” from currency debasement. I can only wonder how long this will last given the Swiss National Bank’s continued unease about the strength in its currency. Or maybe we are embarking on the decade of the franc after all…

Be careful out there!

Full disclosure: long USD/CHF, short GBP/CHF, long FXA, long AUD/USD