After the stock market’s sharp rally off the March, 2009 lows, most solar stocks stopped appreciating by that summer. For the remainder of the year, they experienced wild swings up and down in price in quick succession.

In the summer of 2010, it appeared prospects had finally turned around for the better for solar stocks (as a group). While solar stocks followed the S&P 500 as it cratered to nine-month lows at the beginning of July, most solar stocks managed to avoid following the general market as it plunged again in August, almost testing the July lows. Specifically, the S&P 500 gained 3% during this stretch. Only 3 of 16 solar stocks on my list (more on them below) performed worse. Seven stocks gained at least 25% (Jinko Solar topped the list with a 152% gain), and 2 additional stocks recorded double-digit gains. It was partly this performance that prompted me in early September to note a stealth rally in solar stocks (I had to do two related updates after that post).

Fast forward to today and solar stocks are reeling, speeding in reverse, and far under-performing the general stock market. Wednesday’s particularly poor one-day performance was blamed on Suntech Power’s earnings report and a major downgrade of solar stocks from Credit Suisse analyst Satya Kumar. This downgrade came at a very vulnerable time as selling in solar stocks has been accelerating in November.

Instead of throwing up a bunch of stock charts to describe the carnage, I decided to provide stock-specific price performance over two periods of interest: since the end of August and since each stock hit a recent peak.

The summer’s stealth rally exploded upward into a soaring September. Six of sixteen solar stocks that I closely follow have now lost all those gains. The table below shows price performance since the close of August. The S&P 500 is up 12% over this time period. LDK Solar far outperforms the pack in this view:

Price Performance of sixteen publicly traded solar stocks from August 31, 2010 to November 17, 2010

LDK (LDK Solar Co., Ltd): 61%

SPWRA (SunPower Corporation): 23%

ESLR (Evergreen Solar, Inc.): 21%

JASO (JA Solar Holdings, Co., Ltd.): 18%

CSUN (China Sunergy Co., Ltd.): 15%

WFR (MEMC Electric Materials Inc.): 14%

CSIQ (Canadian Solar Inc.): 13%

ENER (Energy Conversion Devices, Inc.): 4%

JKS (Jinko Solar Holdings Co): 4%

SOL (Renesola Ltd): 3%

STP (Suntech Power Holdings Co., Ltd): -3%

FSLR (First Solar, Inc.): -4%

YGE (Yingli Green Energy Holding Co): -7%

SOLR (GT Solar International, Inc.): -8%

TSL (Trina Solar Ltd.): -12%

SOLF (Solarfun Power Holdings Co., Ltd): -19%

October put an end to most of these rallies even as the general market continued to crawl upward. After solar stocks began peaking, sellers gained more and more strength. For anyone who chased solar stocks into these peaks, the last few weeks have proven costly. The list below shows the losses of each of the sixteen solar stocks since they peaked at their respective intra-day highs. The list is ordered by the date of the peak. Note how many solar stocks peaked on October 14. This was right before news broke of an escalation in the trade disputes between the U.S. and China, this time involving green energy. At the time, I expressed relative optimism:

“I believe that any dispute will be resolved without creating a damaging change in overall market dynamics. Any ensuing sell-off from this news of a brewing trade dispute likely represents a fresh buying opportunity – assuming of course that this quarter’s earnings announcements proceed at least as well as last quarter’s.”

I even guessed that Chinese solar companies would be hit hardest. As it turned out, the announcement of the green energy trade investigation initiated a tremendously profitable shorting opportunity, especially in Chinese solar stocks, The buying opportunities continue “improving” as prices continue dropping. Earnings reports this quarter have arguably out-performed last quarter’s and have included bullish pronouncements about 2011. However, the market currently does not care; or, in the case of shops like Credit Suisse, have concluded that solar companies have become over-optimistic and are creating too much production capacity.

Price Performance of sixteen publicly traded solar stocks from their respective recent peaks to November 17, 2010

SOLF, 9/30, -37%

YGE, 10/14, -27%

CSUN, 10/14, -11%

CSIQ, 10/14, -25%

TSL, 10/14, -29%

ESLR, 10/14, -32%

JASO, 10/14, -29%

SOL, 10/14, -41%

STP, 10/14, -28%

WFR, 10/15, -15%

FSLR, 10/28, -20%

JKS, 11/4, -39%

SOLR, 11/8, -29%

LDK, 11/9, -27%

ENER, 11/12, -11%

SPWRA, 11/12, -11%

Needless to say, this has been a time of pain for those who have held solar stocks through all this selling. I took an approach of waiting for earnings reports and then looking for subsequent dips in price (see previous posts). My plan has been to scale into positions, but I certainly was not anticipating the current rapid implosions in price (even with the general market finally tumbling from overbought conditions).

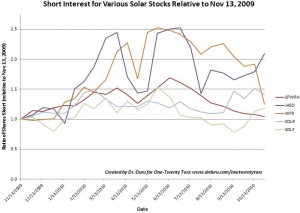

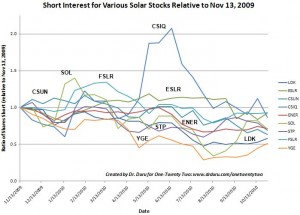

Interestingly enough, shorts in general did NOT sniff out this opportunity. With the exception of Jinko Solar, shorts did not jump appreciably ahead of the selling. For many solar stocks, short interest remains relatively stable or continues to retreat. I have posted two charts to make it a little easier to make out the movements of individual stocks. The charts use data from NASDAQ.com dating back to November 13, 2009. I normalize all short interest to 1 on this date to allow for relative comparisons. The first chart shows those stocks that have experienced year-over-year gains in short interest. The second chart shows those solar stocks with year-over-year reductions in short interest.

Click on the charts for a larger view:

Source: NASDAQ.com

(Click on charts for a larger view)

At this point, I am just about full of all the solar I can take. I used Wednesday’s selling to complete my buying into FSLR, purchased my second of three tranches for JKS, and initiated purchases in SOLR and SOL (trades recorded in twitter under the #120trade hashtag). Plenty of risk abounds, and I may look back on this experience wishing I had remained flexible about shorting solar stocks. But for now, I am sticking with my latest strategy of following the earnings reports as best I can to guide an accumulation of specific solar stocks for more enduring trades.

Be careful out there!

Full disclosure: long FSLR, JKS, ESLR, SOL, SOLR, WFR, and SPWRA, long SSO puts