OK, by “stealth” I really mean I have not paid close enough attention to the rallies in several solar stocks. 2010 has been a year of true divergence for solar stocks. Some solar stocks have been in year-to-date rallies and others have been declining all year. The net result is an awful -25% year-to-date performance for the Claymore/MAC global Solar Energy Index ETF (TAN). The winners are even more notable given the general stock market is down for the year. This year’s best performers are Renesola and Solarfun which are well-ahead of the entire sector. LDK and Trina Solar cling to small to marginal gains for the year after experiencing big losses earlier this year. First Solar rounds out the list with a flat performance year-to-date.

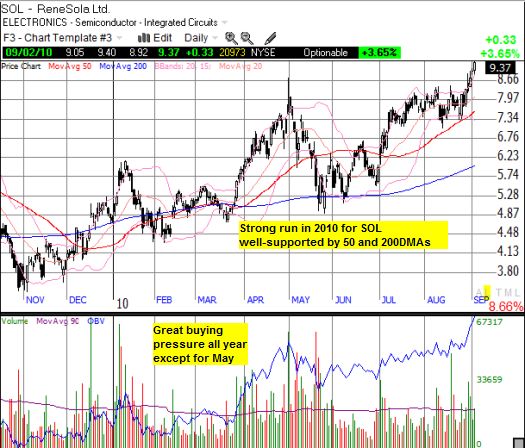

ReneSola (SOL)

I wrote about SOL several times last year as bullish options activity brought the stock to my attention. I completely lost track of SOL this year. Too bad. SOL has nearly doubled this year and is sitting at two-year highs. I cannot recall the last time I could say something like that about a solar stock!

SOL issued a bullish earnings report last month, including increasing guidance for Q3 revenue to $300-320M vs. $273M consensus. The company also slightly boosted full-year revenue guidance to $1.00-1.05B vs. $991M consensus. The stock remains relatively cheap at a forward P/E of 6.7, price-to-book (P/B) of 1.7, and price-to-sales (P/S) of 1.0. However, debt versus cash is a bit higher than I would like, $577M vs. $171M respectively.

Until this trend breaks and/or SOL reports poor earnings, the stock is a buy on the dips.

Solarfun Power Holdings Co Ltd (SOLF)

I have never taken SOLF seriously. Yet, here it is up 53% for the year and re-challenging its 52-week and two-year highs. Trading has been extremely choppy, but good earnings news has prevailed for SOLF. SOLF is even cheaper than SOL with only a 2x debt-to-cash ratio. Despite this, I still cannot get over my bias that SOLF is only for pure speculation.

LDK Solar Co Ltd (LDK)

I essentially wrote off LDK last year after revelations in financial disclosures that the company was struggling to remain a going concern. Nine months later and LDK is still humming along. The stock is up 9% for the year, but it has also been down as much as 29% – not a good risk/reward balance. The stock has a low valuation (of course), but the company sits on a massive $2.1B debt load. LDK holds $441M in cash as of second quarter reported earnings. (correction 9/8). During August earnings, LDK issued revenue guidance that blew away analysts: Q3 revenue $570-600M vs. $422M consensus; FY10 revenue $1.95-2.00B vs. $1.59B consensus. A week after earnings, LDK announced it will heavily invest in a new solar cell and module facility. If LDK is doomed, the company is going down swinging.

Trina Solar Ltd (TSL)

Trina Solar was the darling of the solar industry last year and was its best performer with an amazing 482% gain. TSL did so well that the company could even boast about challenging First Solar. As is so often the case, and as expected, performance championships last no longer than a year, and in 2010, TSL is fortunate to eek out a 3.4% year-to-date gain (this is much better than the -57% performance of last year’s other darling, Canadian Solar, CSIQ!). TSL was down as much as 38% at the nadir in May.

TSL has sprinted 25% since reporting earnings in August when it reported strong year-over-year gains. For example, revenues rose 147% year-over-year to $371M on a 249% increase in shipments to 225MW. Gross margin of 32.1% far exceeded company projections for the high 20s. TSL boosted full year guidance on PV module shipments to 900 – 930 MW, far exceeding earlier guidance of 750 – 800 MW. Naturally, TSL is extremely bullish on its prospects; the company is aggressively expanding capacity and expects to continue driving the costs of its modules downward.

TSL remains relatively inexpensive: 9.8 forward P/E, 1.5 P/S, 2.1 P/B, $640M in cash, and just $627M in debt. The stock’s recent moves put it over its April highs and on a trajectory to regain the momentum it left behind in 2009.

First Solar (FSLR)

I have actively followed FSLR throughout the year. I last claimed the stock would stay stuck in limbo without any positive catalysts on the near-term horizon. This limbo lasted for a month. Yesterday, FSLR pushed to break the deadlock with a small break-out that finally closed the gap down from July’s earnings. The move also flattened FSLR’s performance for the year, barely qualifying it as a “winner” for this list. FSLR has been down as much as 24% this year as it has tested its $100 support line twice.

FSLR is now right back to its downtrend line at the same time the stock is getting overbought, making it ripe for a pullback. I chose to fade the move as part of a hedge on other (non-solar) positions ahead of Friday’s job’s report and the expected return of trading volume after Labor Day. A continuation of the buying pressure from here will be very bullish for the stock.

FSLR remains as “expensive” as ever: 16.6 forward P/E, 3.8 P/B, 5.1 P/S. The cash horde remains impressive at 796M with a paltry $141M in debt.

*All charts created using TeleChart:

As we go through the final trading months of the year, I will be watching these and other solar stocks more closely. With long-time survivor Evergreen Solar (ESLR) on the ropes, the industry could finally be heading for a year in which the winners put a permanent distance between themselves and the losers (amongst the publicly-traded companies anyway).

Be careful out there!

Full disclosure: long FSLR put

STEALTH – QTMM and subsidiary Solterra Renewable Technologies, Inc. are probably the best kept secrets out there. Check out the first finding of any news in months. The Best of Both Worlds published in Nature Photonics

Quantum Materials Corp/Solterra making plans to provide solar cells for a 1GW Solar Farm http://tinyurl.com/TQD-cells-for-1-GW-Solar-Farm

Many of the existing solar companies just making it will go under. It’s going to get ugly out their in the transition but I believe you’re looking at the new leader in the making. http://bit.ly/92G9kp

Do your DD.

Long QTMM