Now that the bearish/selling signal for gold (and silver) seems ready to pass without incident, I thought I would take another look at a sentiment analysis on gold. Since little has changed in the three months since I concluded that skepticism towards gold remained high, I am taking a slightly different spin this time around.

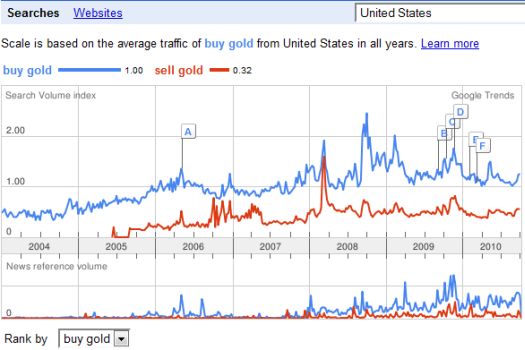

First, amazingly enough, Google searches on the terms “buy gold” and “sell gold” continue their meandering pattern of the last two years in the United States. If a bubble psychology had taken hold, one might expect new interest in gold to show up in search activity as new buyers search for how to get a piece of the action.

Source: Google Trends

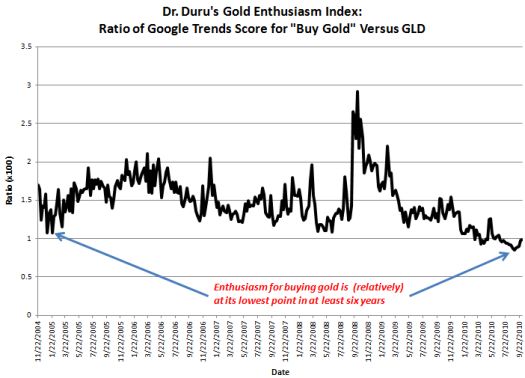

Most notably, searches on “buy gold” are near their lows of the past two years even as gold continues pressing fresh all-time (nominal) highs. This point is further highlighted by taking a ratio of the search volume index and the price of gold using the SPDR Gold Trust ETF (GLD). This “enthusiasm index” indicates that the interest in gold relative to price has not been lower in at least the last 6 years.

(GLD prices available only to late 2004)

The huge spike in enthusiasm in the Fall of 2008 occurred as searches surged in parallel with a plunge in gold’s price – smart buyers, even if some were a bit early during the smaller surge of searches in the Spring of 2008.

Of course, there are a few drawbacks to this approach. For example, the vast majority of interested buyers may already be in gold and have no need to search on “buy gold.” The vast majority of buyers who needed to do searching may have gotten their fill in the search frenzy in late 2008 and early 2009 when gold was selling at an incredible discount. Similarly, these buyers likely already know how to sell their gold when they are ready to do so. Moreover, the relative newness of advanced internet search technology leaves us with insufficient data to validate the strength or accuracy of this approach to studying bubble-like sentiment.

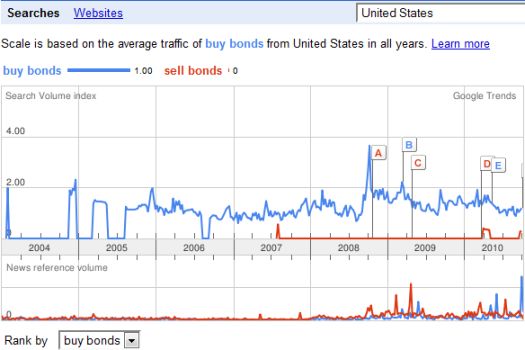

To try to address the last point, I will periodically check in on search sentiment on the feared bubble in bonds; the trend data only extends to 2004 so I cannot make a relative comparison to the bubbles in housing or technology stocks. Sure enough, Google searches on “buy bonds” have remained very calm ever since a surge in interest as bonds soared in price during the financial collapse in the fall of 2008.

Source: Google Trends

The analogous increase in searches on buying gold and bonds in 2008 do provide some suggestive confirmation that this approach to studying sentiment has some validity, especially under the context of extreme price moves.

The one glaring difference between the Google trends for “buy gold” and “buy bonds” is that the news references for “buy bonds” have soared in just the last month. News references for “buy gold” have actually plunged during this time. This inverse correlation makes me wonder whether the bond market is proving more fascinating in the media than gold. After all, the Federal Reserve will be buying bonds, not gold, to execute its second phase of quantitative easing.

In the meantime, I keep waiting for the skeptics to finally nail gold because I am eager to do a fresh reload of positions. As long as paper currencies plaster the planet in ever-increasing quantities (to help pay down ballooning debts and to fight with other chronic printers) relative to the constrained supply of the yellow metal, I will stick with the folks searching on “buy gold.”

Be careful out there!

Full disclosure: long GG