For many of us, investing over the last 10 years has been much more difficult and a lot less fun than it was in the 90s. In the 90s, it was easy to accept the religion of “buy and hold”, keep the faith that assets are pre-ordained to increase in value, and drown oneself in the doctrine of the “Great Moderation” and the banishment of the business cycle. So, I am always pleasantly tickled to stumble into a real live raging bull who still thinks of the world in terms of 10-15 year bullish investment theses.

And stumble I did when a good colleague of mine at work greeted me with a huge grin after having discovered some of my postings on Seeking Alpha. It is cool to pretend I have some kind of celebrity status because I am crazy enough to expose my investing and trading opinions to a skeptical and critical public audience, but after we tangled with the fun and games (including some ribbing over my opinions on Intel – more on that later), we got to the serious stuff.

It was a great day for a bull like my friend (I will call him Mr. Bull) to talk to a stubborn doubter like myself. The market was up almost 2% despite Ben Bernanke’s reminder that the economic recovery remains fragile and has slowed down a bit. The S&P 500 had broken through important resistance at the 200-day moving average (DMA). The index is now within a hair of the last line (the June highs) separating my doubts from a trip kicking and screaming to the side of the cheering (some taunting) bulls . (Tradermike summarizes the technical picture here). What could I say? A litany of immediate ominous economic developments are but speed bumps on a 10-15 year road to riches.

So, I did what any good diplomat would do. I looked for common ground. It turns out we are both skeptical of the idea that the U.S. is about to descend into a deflationary spiral. We both agreed that deflationary scares are opportunities to load up on those things that will soar once inflationary pressures take hold again. One of my favorite money managers, Bill Fleckenstein, was characteristically direct on this topic in “Deflation ‘crisis’ doesn’t exist.” This piece now stands in stark contrast to heavy-hitters like Bill Gross and Jeremy Grantham now taking the side of deflation.

We both prefer emerging markets to the U.S although he is much more adventurous than I am by sprinkling money in things like AFK, the Africa ETF, which is invested about 35% in South Africa. (I am a big fan of Brazil). We both love dividend paying stocks, and we both love TIPS. I shared my pain at ever selling one of my favorites, San Juan Basin Royalty Trust (SJT). We could not figure out a good way of playing an eventual recovery in spot prices in natural gas – I have forever sworn off UNG, the natural gas ETF. We shared our teeth-gnashing experiences of making the anti-deflation bet in the Fall of 2008. Of course, he was much more tenacious than I was.

On the subject of technicals vs fundamentals, I made short change of the discussion by assuring him that a long-term investor like him has little need of it…unless, perhaps, he wants to try to use the 200DMA to stay out of bear markets. However, I did insist that long-term investors essentially do use technicals when acting contrary to extremes in sentiment.

So, why am I bothering relating this story? Well, first of all, I am doing this to encourage him to follow through on a promise to start writing for Seeking Alpha to promote his winning portfolio-building ways. You will know he has start tooting his own horn when I throw up links to the latest “counter”-opinion from Mr. Bull. More importantly, I thought this story would make great context for the fascinating technical juncture of the market.

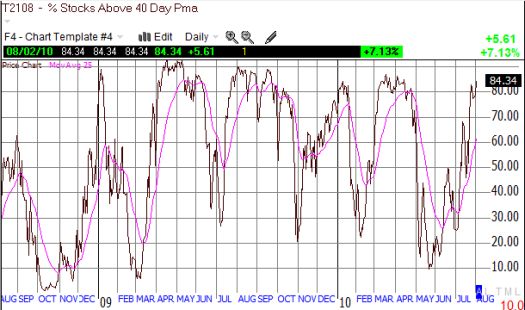

A break of the June highs turns me into an extremely reluctant bull. I will be reluctant because my favorite indicator, T2108, the percentage of stocks trading over their 40DMAs, is at overbought extremes. It is now at 84%, well above the 70% overbought threshold and right at a point that classically marks the end of rallies.

I know I talk about this indicator a LOT when it reaches extremes, even as it broke down several times during severe market extremes in the Fall of 2008 and the sharp Spring, 2009 rally. But when I look at the entire history of this indicator, I cannot help but heed its warnings; it reminds me of the risks involved in freshly jumping on the trend prevailing at the extreme reading. My strategy for dealing with the current situation remains to keep a hold of puts on the major indices and trade (short-term) a few post-earnings moves with a bullish bias.

While I mainly wait out this period, I continue to find amusement in the flip-flopping explanations and excuses for the market that are even more deserving of marvel than a technician reversing course above and below a favorite indicator. For example, I caught a snippet of Larry Kudlow on CNBC joyously belting his favorite refrain that the stock market rally is telling us that things are not so bad after all. His partner dutifully reminded the audience that, after all, the stock market discounts events that are coming 6-12 months ahead. Surely, the promised land is now on the other side of them thar hills! This from a man who believes with so many others (like many of of his colleagues on CNBC, with the common exception of my favorite skeptic Mark Haines) that the country is crippled and paralyzed by an uncertainty brought on by government policymaking and the horrific threat of taxes. In other words, when the market is up, the underlying of strength of America shines through any and all obstacles. When the market is down, it is a result of the machinations of those interlopers who are oppressing the would-be riches available to everyone with two pennies of common sense.

Anyway, I will abruptly end here with another look at Intel (INTC). Mr. Bull declared my bearish position “wrong” given its nifty 2.7% rally on Monday. I chuckled along with him, and let him know that I am not a “passionista” on these things; my term for a person who vehemently expresses an inherent, abiding belief or faith in one direction for a stock or investing thesis. I follow where the data lead me. However, in this case, INTC remains FAR from erasing my skepticism. The stock looks ominous even as it nudged back above support. My gripe is a common complaint endemic to this stock market – buying volume was anemic. “For once”, I would like to see a strong rally supported by strong buyers. Without this vote of confidence, INTC will be very vulnerable to the swarm of sellers that are sure to arrive again soon, especially at key levels of resistance.

*All charts created using TeleChart:

Be careful out there!

Full disclosure: long TIP, long SSO puts