Interpreting the trading volume in options is typically difficult (I did an analysis in three parts last year). But I am most fascinated when a herd of speculators get caught leaning in the very wrong direction.

This is what happened with IMAX. Schaeffer’s Research reported on heavy, bullish activity in the trading of IMAX options on Tuesday:

“On the call side, the security’s out-of-the-money March 15 strike was most popular, with almost 4,200 contracts exchanged. Thirty-five percent of the front-month calls changed hands at the ask price, implying they were likely bought, and call open interest at the 15 strike escalated by about 2,750 contracts overnight. In other words, it appears a healthy portion of yesterday’s activity consisted of the initiation of bullish bets.

Meanwhile, the 15 strike was also most active in the April series, with more than 1,000 puts exchanged. Almost all of the contracts traded at the bid price, suggesting they were sold, and 100% of the puts translated into new open interest, pointing to sell-to-open activity.”

These IMAX bulls ran head-on into bad news today when AMC Entertainment announced it now offers a large-screen, 3D movie experience at Walt Disney World® Resort:

“AMC Theatres® (AMC)…today announces that guests will be able to see movies in a new, entirely superior fashion when the AMC Enhanced Theatre Experience (ETXTM) makes its U.S. debut on March 5 at AMC Pleasure Island 24 at Downtown Disney® Area at the Walt Disney World® Resort.

ETX includes a 20-percent larger screen, 3D technology, digital projection and an upgraded sound system. Specifically, the digital projection system produces images comprised of 2 million pixels, which delivers a higher resolution than HD. This eye-popping image is then showcased on a wall-to-wall, floor-to-ceiling screen that immerses guests in the image.

The ETX auditorium also boasts 12 audio channels fueled by 50,000 watts of power, which is a major upgrade and three times the power of typical auditoriums with six audio channels.”

This kind of technology will definitely give IMAX a run for its money, but I am surprised at today’s violent reaction – a high-volume of selling sent IMAX tumbling hard from a 9 1/2 year high for a -9.8% loss on the day. This news must have been know for quite some time – even if the exact timing of the announcement was not known. So, perhaps there is still some counter-balancing news to come in the next two weeks or so. It is also very possible that just one or two traders placed large (misinformed) bets that other speculators were quick to follow blindly. It is certainly easy for a few deep pockets to generate all this excitement: the 6,950 options contracts discussed above probably amounted to “only” $325K or so in cash volume.

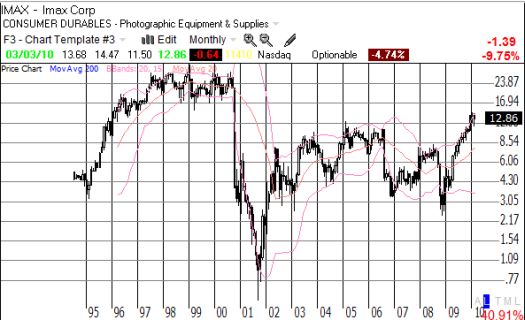

Whatever the scenario, the daily chart below shows that today’s trading formed a potential double-top in the stock. A monthly chart follows to provide the long-term perspective and a visual of the almost decade-long high.

*All charts created using TeleChart:

Be careful out there!

Full disclosure: no positions