The market delivered another tepid response to another stellar earnings report from Intel (INTC). After October’s earnings report, I argued that INTC was hitting peak performance. Trading following that report seemed to support my expectation. Trading after Thursday night’s earnings looks like an exclamation point on what is a potential climactic top in INTC. Prior to earnings, INTC printed fresh 52-week (and 16-month) highs on 2.5x volume only to fall on even higher volume the next day with a gap down to a 3% one-day loss (note that Friday was an options expiration day which potentially exaggerated the trading action).

There is plenty to like in INTC’s report, but I agree with Karl Denninger in “Intel: Nice Performance, But…..” Specifically, I still think these historically high margins mark a peak, and the economic recovery will not support significant revenue growth in the next year or so.

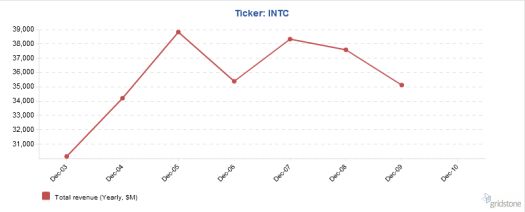

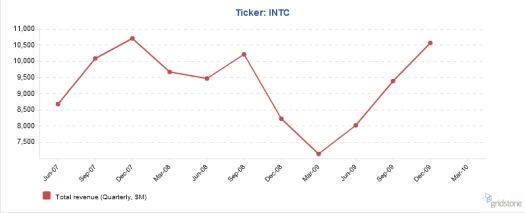

A quick review of history suggests why market participants may hesitate to bet on a significant improvement in results in the near or intermediate-term. After the last recession, INTC’s (total) revenues peaked in fiscal 2005 – about midway between the stock market’s bottom and the final end of the bull market. The stock topped out at the end of 2003, well ahead of the peak in revenues. See charts below (all financial data from Gridstone Research):

*All stock charts created using TeleChart:

The good news is that the quarterly decline in revenues has clearly ended as December’s revenue returned to levels from two years ago.

At a forward P/E of 12, INTC is not expensive. Combine that with a 2.7% dividend yield, and I can sympathize with an argument for holding the stock here. After all, when I last purchased INTC in the throes of fall 2008, INTC had a forward P/E of 12 and a dividend yield of 4%. However, at the time, I had a fairly optimistic expectation for price appreciation:

“…a likely scenario is that INTC rallies at 15-20% within a year, and I get paid an extra 4% to wait around; and the “long-term” scenario is that I nab a double within three to five years.”

INTC hit the one-year target and then some well ahead of schedule. I was compelled to sell because I no longer expected as strong a recovery as I did back in 2008. If INTC manages to make a new high (relatively soon), the near-term (technical) prospects for INTC’s stock should improve…but I am not expecting such a move.

(On a side note, INTC is not the only prominent stock printing an ominous topping pattern. Click here for a review of the potential climactic top forming in Caterpillar (CAT).)

Be careful out there!

Full disclosure: no positions.

Being OED last friday – could be partly responsible since the calls outweighed the puts – and a force down to “max-pain” the calls. Tomorrow Tuesday will be quite a tell for Intel and the market… I have Long-term calls – I sold pre earnings at 3:30 and re-entered same on Friday 3:30. They are Jan 2012’s @10 – Since Intel is about the strongest company in the USA and a P/E of 12 (fwd) – I think it will go very well.Intel rides PC’s, Mac’s, WiMax – and god knows whatever. In most cases in the past 3 years Intel has always sold off to good reports – Just a game – I’m sure INTC is played with very big Money on a daily basis. Lots of newbies to scare off.

That’s the same logic I used to buy in 2008. Tuesday will be indeed a big tell. I like Intel for a trade only if it can overcome Friday’s mess in short order.