At this point, everyone should be used to looking at charts of stocks and indices that look like they are topping out, many in climactic fashion (click here for a review of Caterpillar; click here for a review of Intel).

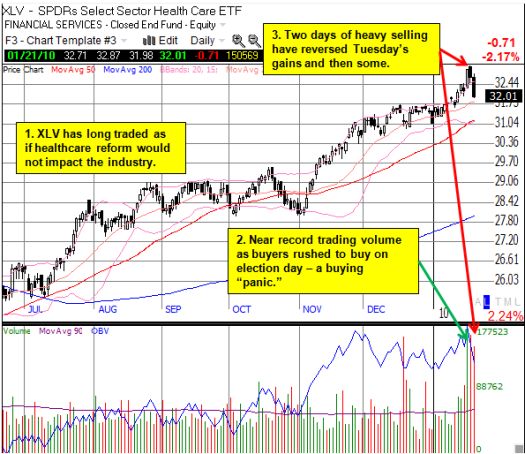

Add healthcare stocks to the growing list. Specifically, the Health Care Select Sector SPDR ETF, XLV, looks like it has topped out in climactic fashion. XLV is experiencing classic “sell the news” action as the consensus seems to herald the end to healthcare reform as a result of the election of Republican Scott Brown to the senate.

However, it was the dramatic options action in XLV combined with the high-volume in trading that really caught my interest. As I posted on Twitter yesterday, XLV’s heavy call volume and insignificant put volume thrown in with a high-volume fade in the stock, all summed to toppy action. When a stock makes a new 52-week high on high volume, investors and traders need quick follow-through to confirm buying interest. The lofty price levels are rejected when the follow-through is instead high-volume selling that quickly reverses all the price gains and then some. XLV’s chart below shows how this scenario has played out so far.

*Chart created using TeleChart:

The options action has been as convincing as the stock action.

As XLV faded on Wednesday, 21,085 Feb 32 calls traded on open interest of 36,734. 21,019 Feb 33 calls traded on open interest of 54,513. Only the Feb 33 puts traded in any significant volume, but that was still only 1,630 contracts against 6,173 open interest. Today’s open interest shows that traders were closing out call positions. Open interest in the Feb 32 calls dropped by 10,000, and open interest in the Feb 33 calls dropped by 20,000. Yet again, put trading was extremely light in comparison with today’s call trading. Options players are proclaiming loud and clear that the trade here is over on the long side.

I bought puts on XLV yesterday and sold them today. I am still holding puts in Cigna (CI) and Aetna (AET) from Tuesday’s ramp. I think that at least in the near-term, rallies in the healthcare sector should be sold/shorted.

As usual, a fresh 52-week high, with good volume and follow-through, invalidates the bearish set-up.

Be careful out there!

Full disclosure: long puts in Cigna (CI) and Aetna (AET)