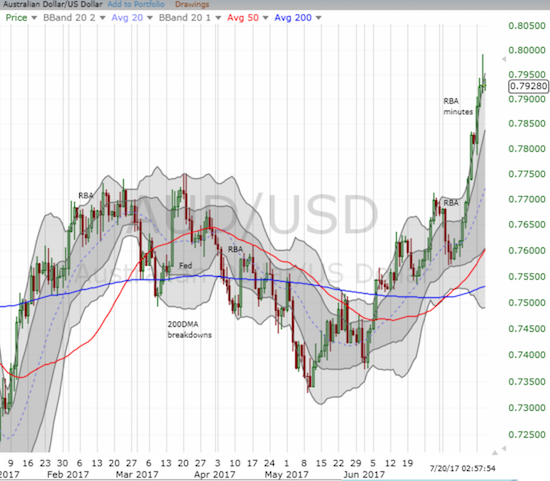

Over two weeks ago I officially ended my bearishness on the Australian dollar (FXA). I made that call just in time.

Source: FreeStockCharts.com

The Australian dollar has powered higher against almost all major currencies and now threatens to retard the economy’s on-going adjustment away from mining investment. The Reserve Bank of Australia has consistently noted its reliance on a weaker currency. For example, in the July 4, 2017 statement:

“The depreciation of the exchange rate since 2013 has also assisted the economy in its transition following the mining investment boom. An appreciating exchange rate would complicate this adjustment.”

Ironically, one of the catalysts that helped drive the Australian dollar to its current heights was the RBA itself. In the minutes from the July policy meeting, the RBA decided to discuss explicitly the value of the neutral interest rate – the nirvana rate where monetary policy is neither accommodative nor tight. Certainly even the casual observer of monetary policy already knows that the neutral rates in the countries of all major central banks are much higher than current levels. Moreover, the RBA’s assessment of around 3% is well below the neutral rate before the financial crisis. No matter, currency markets interpreted the very discussion of the neutral rate as an excuse to assume the RBA had abruptly turned hawkish. From the minutes (emphasis mine):

“Members discussed the Bank’s work estimating the neutral real interest rate for Australia. The various estimates suggested that the rate had been broadly stable until around 2007, but had since fallen by around 150 basis points to around 1 per cent. This equated to a neutral nominal cash rate of around 3½ per cent, given that medium-term inflation expectations were well anchored around 2½ per cent, although there is significant uncertainty around this estimate. Members noted that some of this decline could be attributed to lower potential output growth, but the increase in risk aversion around the time of the global financial crisis was likely to have been a more important factor, given that the bulk of the decline in the estimated neutral real interest rate had occurred around that time. Estimates of neutral real interest rates for other economies had shown a similar decline. All estimates of the neutral real interest rate for Australia suggested that monetary policy had been clearly expansionary for the preceding five years or so. It was also noted that a reduction in risk aversion and/or an increase in the potential growth rate could see the neutral real interest rate rise again.”

This 15-minute snapshot of AUD/USD shows the market’s immediate and sustained reaction to the release of the minutes.

Source: FreeStockCharts.com

The next day, Australia’s Prime Minister Malcolm Turnbull affirmed a hawkish interpretation of the RBA minutes. From the Financial Review:

“‘…I think they are sending a signal, which is probably prudent, which is to say … rates are more likely to go up than go down.’ Borrowers should be aware of that, Mr Turnbull warned.”

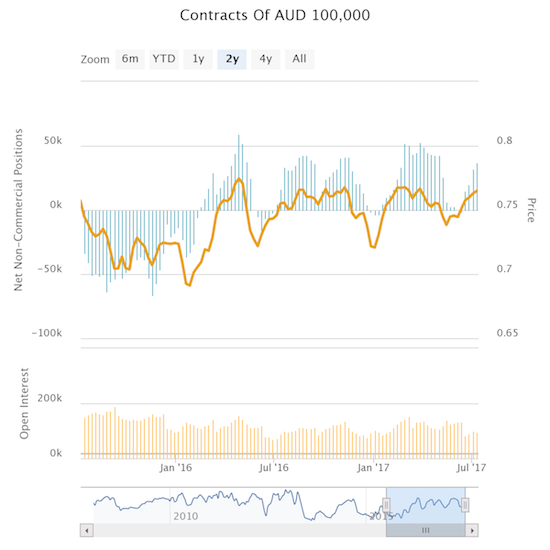

The fresh surge in the Australian dollar comes on top of a tinderbox of catalysts supporting the currency. I am not surprised that a hawkish interpretation generated such a sharp rally. Already, speculators have returned to increasing bullishness on the Australian dollar. Net longs have increased for the last four weeks.

Source: Oanda’s CFTC’s Commitments of Traders

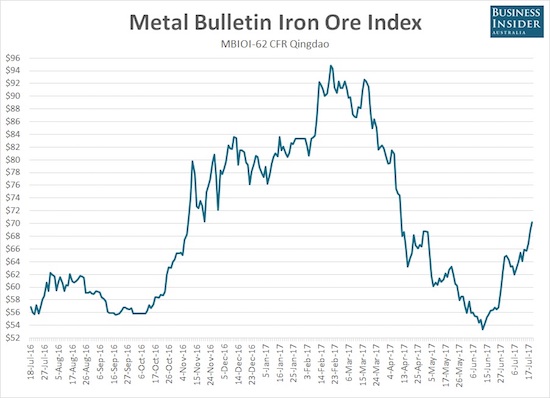

This increasing bullishness has in turn surfed atop surging iron ore prices. The price of iron ore has practically exploded off its last low just over a month ago. Iron ore prices are up an astounding 30% or so since then.

Source: Business Insider

Chinese steel production sits right in eye of the storm for iron ore prices. Chinese steel production has cranked around record levels since February of this year. June’s annualized production of 891 tonnes was a fresh record and clearly motivated iron ore buyers to get back to work. Andy Home from Reuters recently cited several inter-related factors driving steel production:

- Soaring Shanghai steel rebar prices which last week hit a near 4-year high. (link provides graphic sourced from Reuters)

- Record high open interest in Shanghai Futures Exchange (ShFE) steel contracts.

- Record high open interest in ShFE hot-rolled coil (HRC) contracts.

- Capacity shutdowns.

- Strong steel demand from construction companies.

This ultimate dependence on white hot Chinese economic conditions motivates me to expect some kind of sharp pullback in the Australian dollar at some point in the near future. The history of these run-ups is relatively consistent: eventually and resolutely Chinese authorities act to prevent over-heating. I also expect that the RBA will worry about an Australian dollar sitting at levels that, if sustained, will surely complicate the economy’s adjustment period. As a result, the RBA should attempt something to help walk the market off its hawkish assumptions.

So just like that, I am back to considering shorts against the Australian dollar. In particular, I cannot imagine the AUD/USD trading at the lofty 0.80+ level for a sustained period of time. However, I am refraining from returning to a bearish bias; instead, I call this trade “opportunistic” in the context of an Australian dollar has simply gained too much too fast.

On a related note, it is time to consider another pairs trade on the iron ore players. Their stock prices have soared right along everything else related to the iron ore complex. This iron ore rally allowed me to close out the last pairs trade at a net profit.

Source: FreeStockCharts.com – prices posted on the chart are for iron ore as reported by various sources.

Be careful out there!

Full disclosure: short the Australian dollar

Good points Duru. It is a nice scalp short term on overbought conditions, but I don’t see a good medium term trade short AUD. The ducks don’t line up. I think there is a very good chance the RBA put that there intentionally. That AUD has risen sharply and they have not taken it back indicates to me they have taken a hawkish bias. It is the same story as Canada. Unemployment is too low for current rates. They have waited for a calamity in China and with none on the horizon, they will need to hike. The rise in the currency is a de facto tightening but it is mitigated by the employment strength and that the capex cliff from the drop in mining investment has basically washed through the system. Mining capex is unlikely to have a substantial downward drag effect on the economy going forward. I think it will be a great short after a hike or 2, say in about a year when they will have to take it back, say Q3 2018.

The sellers stepped in at 0.8, but the question is, whether it is a long

On the pullback. It is a tough one to call. Normal or strong Australian Q2 inflation results next week and it is game on for a rate hike.

It could be a very marginal buy on the pullback and sell before the Q2 reading. I hate going long when the spec positioning is starting to look overcrowded though. Much less runway for a run up even if there is a hike. In retrospect it is so obvious and I am kicking myself for not buying AUD after the Canadian hike.

0.80 should be a battleground for AUD/USD. I think the bigger wildcard is the on-going sell-off in USD. The RBA confirming hawkishness risks a very quick run-up to 0.85 or higher at this rate. As I noted in my post, I am definitely not flipping bearish on AUD. I just don’t see 0.80 giving way *until* the RBA does something to confirm its hawkishness, and I am still on the skeptical side they are ready to watch the Aussie soar even higher. Should be interesting!

And you’re right: in hindsight, AUD was a long after Bank of Canada hiked.

Interesting move in NZD today and it is reaching a very interesting level. I think it could be a short here. 0.75 will probably be defended like 0.8 for AUD. with NZD there is the general election 27 sept. Somewhere between now and sept 27, it should be a setup for a short. I will be interested In the spec positioning this week but it may have increased again from the already pretty extreme level it was. There are a lot of carry traders piling in.

I started small positions today short nzd.usd, short nzd.jpy and long aud.nzd