Trading for the iPath Bloomberg Cocoa SubTR ETN (NIB) could have started quite negatively this week. Yesterday, On May 29th, Bloomberg reported from unnamed sources that Ghana’s main crop for the cocoa growing season would produce its highest tonnage in three years:

“Graded and sealed deliveries from the so-called main crop, the larger of two annual harvests, reached 812,153 metric tons by May 25, said the people, who asked not to be named because the information isn’t public. That compares with a combined 778,043 tons for the whole of the 2015-16 season, when severe desert winds damaged crops and affected rainfall.”

Yet, this crop report (rumor) is truly yesterday’s news. Expectations for the future are much more important. In the Ivory Coast, reports of heavy rains rang alarm bells for the ability of farmers to cultivate their cocoa crops. According to Reuters Africa:

“Abundant rainfall fell last week in most of Ivory Coast’s main cocoa growing regions, sparking fears that flooding could hinder harvesting of what is otherwise expected to be a strong mid-crop, farmers said on Monday…

‘The soil is very wet. If that continues there will be flooding and we will lose a lot of cocoa,’ said Etienne Yao, who farms on the outskirts of Aboisso in the southeast.”

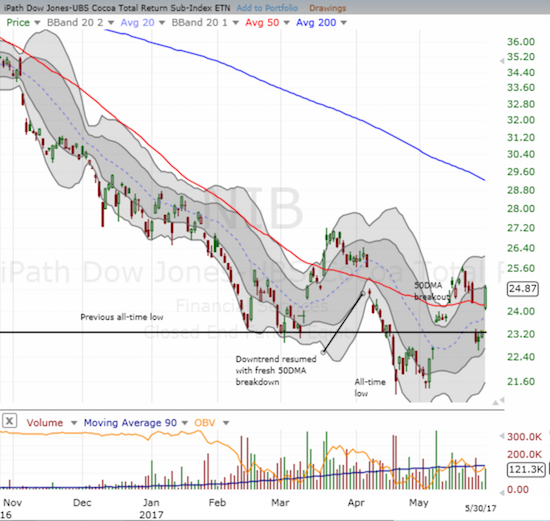

This report marks at least the third weather-related, sharp turn of events in the past 4 or 5 weeks. Traders responded dramatically. NIB soared 6.7% and broke out above its downtrend defined by its 50-day moving average (DMA). This is the second 50DMA breakout in May and the third in a little over 2 months.

Source: FreeStockCharts.com

NIB’s rally mirrored the surge in cocoa futures. The move was abrupt and sharp enough for Bloomberg to speculate on “The End of Cheap Chocolate.” According to Bloomberg:

“July futures jumped as much as 6.8 percent, the most ever for the contract. Farmers in West Africa are already locking in more forward sales for next year’s crop than traders were expecting, a sign that supplies from the current harvest are beginning to ebb.”

The forward sales are important context because Ivory Coast has already sold forward 950,000 tons of cocoa beans from the 2017-18 main crop. While these farmers are locking in what I think are very low prices, I understand the eagerness given the persistent downtrend in price since cocoa hit record highs last year. Yet, the sales also demonstrate the kind of high demand that potentially signals an imminent bottom in prices. Indeed, Bloomberg provided data from the Commodities Futures Trading Commission (CFTC) that shows speculators have backed off massive short bets for the third week in a row. Bearish bets are back to levels last seen in mid-April.

This roller coaster of weather news has further convinced me to stay the course and focus on treating this low price in cocoa prices as a longer-term buying opportunity. I am betting on the story of a secular uptrend in demand and not the vagaries of weather from season to season. The incrementally stronger price action in NIB since March is tantalizingly close to validating my approach. I just need to see a higher high…

Be careful out there!

Full disclosure: long NIB