Watching 200DMA retest for $AAPL. Success if it closes above Friday's high.

— Duru A (@DrDuru) Aug. 3 at 06:56 AM

Am officially holding breath on mkt as one of its props, $AAPL, has broken down below 200DMA for first time in 2 years. =gulp= $QQQ $SPY

— Duru A (@DrDuru) Aug. 3 at 05:00 PM

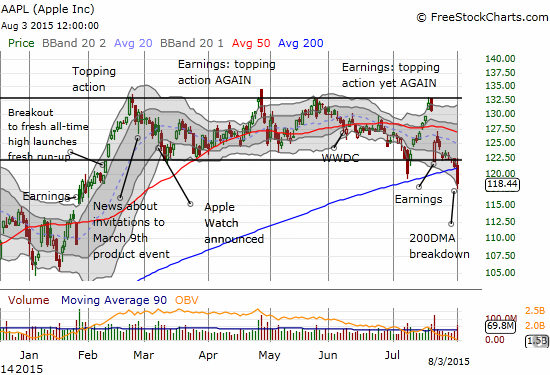

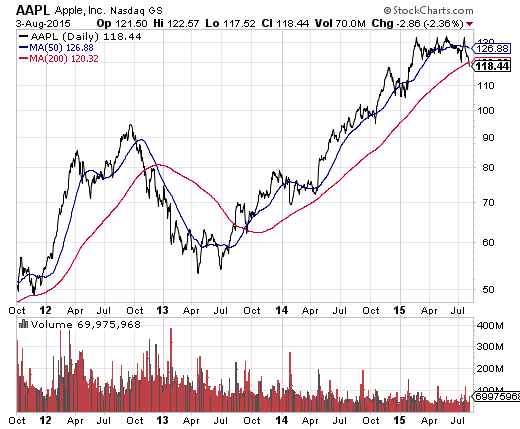

The first trading day of August began in a promising fashion for Apple (AAPL) as it rallied off its 200-day moving average (DMA) and reversed all of Friday’s losses. I was getting set to call “victory” for AAPL and load up on call options. I stopped in my tracks when later I saw the stock crater right through its 200DMA support on a nasty reversal of fortunes. Apple closed with a 2.4% loss that marked the first time in two years that it closed below its critical 200DMA support.

Source: FreeStockCharts.com

Source: StockCharts.com

The first daily chart shows that not only did AAPL break down below its 200DMA but also the trading range that kept AAPL pivoting around its 50DMA since February has definitively broken. While I want to remain bullish on AAPL, the chart says otherwise. AAPL will need to close above its 200DMA with subsequent buying follow-through in order to turn the tables on the grumpy bears. Apple’s performance has been so consistent in recent years that a simple strategy to trade on the 200DMA has been sufficient for riding new all-time highs and bailing before giving back substantial profits.

It has been a while since I have updated my various tools for trading AAPL. I am in the process of fixing that.

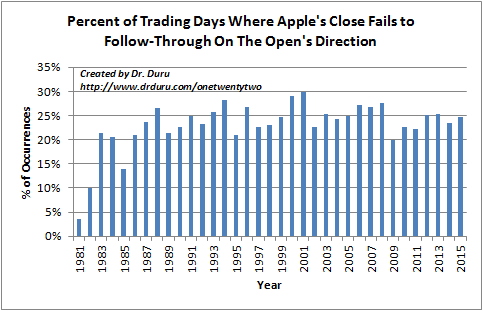

First, in “The Apple Trading Model Simplified” I demonstrated the day-trading power of simply trading in the direction of AAPL’s open. Since then, the percentage of days in 2015 that violated this rule declined toward the percentages of prior years. Note however that since AAPL’s July earnings, the stock has experienced a surge in reversals from the open…including today’s breakdown.

Second, I have updated the Apple Trading Model (ATM) decision (regression) trees. I still prefer to use the simplified model when I decide to daytrade AAPL and have not gone back to the original ATM since developing the simplified model. After I recognized the trading range on AAPL, I shifted again to trading on the range and the 50DMA pivot. However, I now plan to run the ATM more frequently as potential context for AAPL’s critical juncture. For more detail on the original trading model, see “The Apple Trading Model (Re)Explained.” Here are the links to the trees:

Trade from the open – provided for completeness (2010 and 2011 are not available)

2012

2013

2014

2015

The classification error on these models ranges from 18 to 22%. Applying the model to the historical data provides actual error rates of 16 to 24%. The years 2014 and 2015 have the lowest. This is a very happy consistency between the classification and actual errors.

Trade from the previous close

2010

2011

2012

2013

2014

2015

The classification error on these models ranges from 25 to 34%. The years 2014 and 2015 have the highest rates – something I do not think I have seen in any update. Applying the model to the historical data provides actual error rates of 27 to 47%. The years 2014 and 2015 have the lowest.

Next up, an update and discussion of the Apple Pre-Earnings Trade.

Be careful out there!

Full disclosure: long AAPL call options (not expecting these to retain value much longer!)