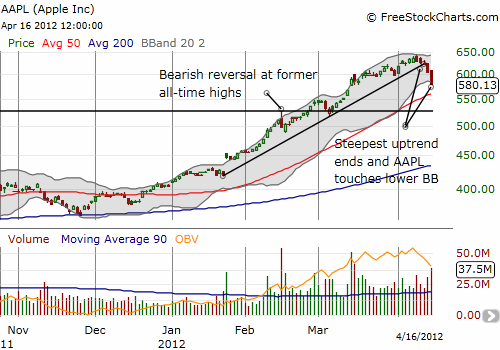

Apple (AAPL) has had a rough five days. The stock has sold off for five straight days on very high selling volume with losses increasing the last two days. The 9.7% loss pales in comparison to the year-to-date 43% gains. However, this recent selling is just as ominous as the last topping pattern Apple printed in mid-February…a whole 10% ago now.

Note well that AAPL’s tag of the lower Bollinger Band (BB) is a first since November, 2011. That tag was followed by persistent weakness for another two weeks before AAPL turned and never looked back. We should expect sustained weakness again, especially with the high volume of selling. When a stock tags the Bollinger Band as it widens, like now, the stock typically maintains its momentum for a notable period of time.

Earnings on April 24th will be Apple’s big wildcard. The weakness could very well end with a huge sigh of relief after those earnings. Until then, it seems clear some large constituency is eager to get out well before that earnings report. Perhaps it is too close to “sell in May.”

Like the last topping pattern, I am firmly voting against shorting Apple here. While Apple wasted no time in reversing the last topping pattern, I have to believe this time around will take a lot more work given the huge profits that many traders are holding in this stock. Even so, I greatly prefer to take advantage of weakness to buy. At the open, I had to abandon an April 615/610 short put spread, but at the close I switched into a May 610/620 call spread. I am saving powder for at least one more purchase on additional weakness (likely a longer-term position).

Be careful out there!

Full disclosure: long AAPL call spread