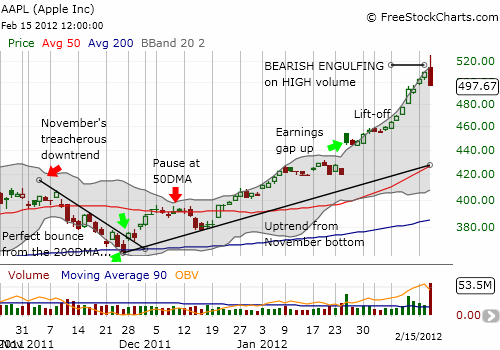

February 15 was a day noted around the world: Apple (AAPL) made a major bearish reversal that even non-technicians could appreciate for its fury. Here is the chart I produced on that fateful day:

The tremendous surge in trading volume was a 13-month high and followed the S&P 500 down for the day – adding more evidence that Apple had printed a major topping pattern. At the time, I was VERY careful to say this was not a time to short Apple but instead I was looking for a fresh buying opportunity:

“Despite the ominous technical patterns, I am not a bit interested in shorting Apple here. Instead, I am eagerly looking for a re-entry point. This topping pattern tells me to take a deep breath, pause, and be patient. Apple can of course overcome the topping pattern, but it will like require time, the shake-out of weak hands, exhaustion of selling, AND THEN finally the re-ignition of buying interest and power. Tops are usually a process, not an event.”

Well, “time” was all of two weeks. The “topping” process has featured stubborn and persistent buyers, with convincing volume, pushing Apple upward in a new straight line as seen in the chart below. The fresh run has paused just long enough to tease us by matching the closing all-time high with the former intra-day all-time high.

Source: FreeStockCharts.com

AAPL has now obliterated the bearish reversal and invalidated that sell signal. This will leave every technician scrambling to recalibrate. Best of all, the stock has returned to a happy place where nearly every single person holding a share of Apple is sitting on at least a penny of profit. Given the general market’s stubborn rise, I can only assume Apple holders will now be content to relax again and watch this stock resume its ascent to the heavens.

I sold my April $590 calls last week because it seemed Apple’s momentum could no longer win its fight with time decay. Sure enough, despite Apple’s amazing accomplishment, those calls remain about 5% below where I sold them. Since I am not a chaser, all I can do now is sit back and watch and wish Apple fans good luck. Momentum players are likely to pile back into Apple if they have not already returned. The very short-term excitement can be seen in the trading in options expiring this Friday.

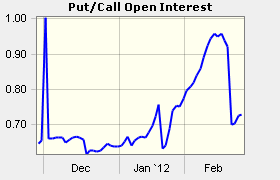

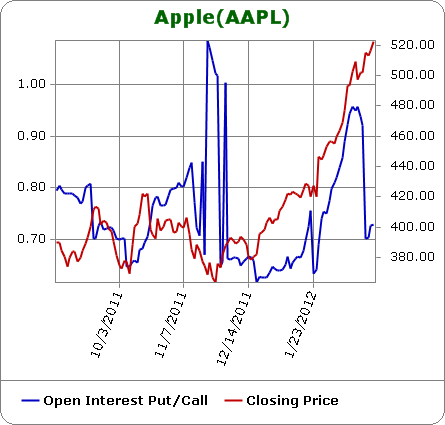

For options “near-the-money”, with strikes from $500 to $550, trading volume in the calls expiring March 2nd was almost twice the trading volume in the puts expiring March 2nd: 150,995 versus 76,030. Open interest was much more balanced with 37,037 calls versus 21,233. In other words, the bulls are roaring loud here. To put this trading in even better context, the put/call ratio was soaring into Apple’s previous top as seen in a historical chart from Schaeffer’s Research:

Source: Schaeffer’s Research Apple stock quotes

(The put/call ratio is measured using options with less than 3 months left to expiration).

Clearly, skepticism about Apple was running higher and higher with price and/or shareholders were rushing to protect positions. After all, Apple could not buy love as late as November when the put/call ratio was bouncing wildly as the stock struggled near October’s lows. One might imagine that as Apple kept running, put buyers protecting positions finally locked in profits as their puts began to provide little downside protection. Perhaps even the skeptics who were trying to bet on a top all decided at once to provide the blow-off top symbolic of the rush of the “last” buyers finally buying into the rally. Now, even THEY can be relieved…assuming they held on for dear life.

Be careful out there!

Full disclosure: no positions