(T2108 measures the percentage of stocks trading above their respective 40-day moving averages [DMAs]. To learn more about it, see my T2108 Resource Page. You can follow real-time T2108 commentary on twitter using the #T2108 hashtag. T2108-related trades and other trades are posted on twitter using the #120trade hashtag)

T2108 Status: 62%

VIX Status: 14.3%

General (Short-term) Trading Call: Hold with a bullish bias

Reference Charts (click for view of last 6 months from Stockcharts.com):

S&P 500 or SPY

SDS (ProShares UltraShort S&P500)

U.S. Dollar Index (volatility index)

VIX (volatility index)

VXX (iPath S&P 500 VIX Short-Term Futures ETN)

EWG (iShares MSCI Germany Index Fund)

Commentary

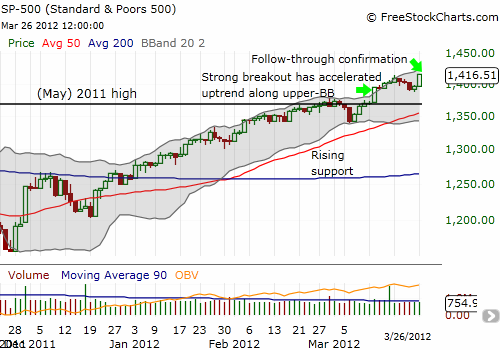

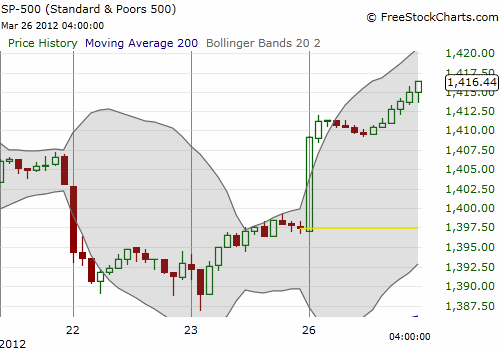

So much for wiping out the gains from the S&P 500’s big breakout on March 13th. In my last update, I gave the bearish case its due just for the sake of completeness. That case is now far in the rearview mirror for now. Today, the S&P 500 printed an important confirmation and follow-through to the current bullish trend. With T2108 still below overbought levels at 62%, the major index is still “all systems go.”

Incredibly, a LOT has happened in just two trading days. I will summarize the T2108-related action by describing the trades I made and their rationale and/or context (you can follow the timeline with my #120trade hashtag in twitter).

Bought FXP (ProShares UltraShort FTSE/Xinhua China 25 ETF) shares

In the last T2108 update, I put FXI, an ETF of 25 large cap Chinese stocks, on my bearish list given a new 2-month low. I bought FXP, the inverse of FXI. While this position naturally moved against me today, I realized that FXP is a great hedge given it seems China may likely produce the next source of market angst. If so, FXP should deliver some cushion against the blow. FXI remains below its 200DMA.

Missed doubling down on more SSO weekly calls

Once again, I failed to get aggressive enough…even as I believe I am shaking all lingering bearish doubts from my trading finger. I lowballed my offer despite the calls losing as much as 33% of their value at Friday’s lows. The chart below shows how little time I had to decide to accumulate. If I had managed to execute, those calls would have delivered about a 120% gain when I decided to sell my SSO calls into Monday’s open. Instead, I gathered a 58% gain on the first tranche of SSO calls. I did decide to hold onto my April SSO calls. As a reminder, my strong bullish bias has the short-term horizon of a swing trader (1 to 3 days), so weekly calls typically serve my purpose as a cheaper way to buy the dips. The longer-dated SSO calls are added firepower against the SDS hedge.

Closed out BBY “catch-up play”

For more information on this trade and my analysis of the coming earnings play in BBY see “How To Assess Best Buy’s Post-Earnings Potential.”

Ended the torture of holding VXX shares

Nothing has been more destructive to my performance than VXX shares. I finally gave myself MAJOR relief by unloading them on Friday. I simply could not trade VXX puts fast enough to keep up with VXX’s losses. I replaced the shares with April calls that I am holding as “just in case” we wake up one morning to something truly crazy. I suspect there are still way too many bears that are doubling and tripling down on VXX waiting for just that magical (Black swan) moment. I married the calls to even more puts, the better risk/reward bet for now. Those puts soared in value at Monday’s open as VXX quickly fell another 6% to fresh all-time lows. I happily sold them. VXX ended the day down over 9%. This thing got so ugly, I decided near the close to apply some of my profits from the March weekly puts into buying out-of-the-money April puts. VXX’s chart exclaims 1000 words and death by 2000 cuts.

Back into the euro-plays with Siemens (SI)

The euro-plays get me the most excited right now. They are more in my contrarian comfort zone whereas the bullish plays on the S&P 500 are all about trend-following. With Europe rallying overnight, I checked in on Siemens (SI) to see how far it had popped. To my surprise, Siemens was flat. For comparison, EWG, the Germany ETF, closed the day up a cool 2.2%. SI is still directly below critical resistance so I am taking a larger risk than usual, but I feel it is worth the shot with EWG looking ready to launch to fresh 8-month highs. I consider Siemens a classic “catch-up” stock as it will be a natural play for anyone wanting to participate in a European recovery. I started with calls. If Siemens manages to drop below $90 or so, I will begin accumulating shares to hold for the longer haul.

What now?

With the S&P 500 at fresh multi-year highs, it seems crazy to maintain such a bullish bias, yet, the data told me to do it. While I suspect tomorrow’s open will make me wish I still had all my SSO calls and original collection of VXX puts, I will stay focused on the current strategy of buying whatever dips the market presents and then selling into the next rally. I continue to expect a lot of churn with a slight upward bias that produces numerous bullish trading opportunities, including shifts in and out of overbought territory. Last week’s dip was a PERFECT example of what I talked about earlier as part of my expectations: the continued frustration of bears as selling lacks the critical follow-through to break down the S&P 500. This week’s open printed an exclamation point as the S&P 500 recaptured ALL of last week’s losses in a flash. That impressive move occurred on decent (meaning average) trading volume. This follow-through and fresh breakout must thus be respected and given its due…

When T2108 next hits overbought territory, I hope to re-examine the data supporting the bullish case. Until then, stay nimble and keep an open mind.

Charts below are the latest snapshots of T2108 (and the S&P 500)

Refresh browser if the charts are the same as the last T2108 update.

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Weekly T2108

*All charts created using freestockcharts.com unless otherwise stated

Related links:

The T2108 Resource Page

Expanded daily chart of T2108 versus the S&P 500

Expanded weekly chart of T2108

Be careful out there!

Full disclosure: long SDS and FXP; long SSO and SI calls; long VXX calls and puts