(T2108 measures the percentage of stocks trading above their respective 40-day moving averages [DMAs]. To learn more about it, see my T2108 Resource Page. You can follow real-time T2108 commentary on twitter using the #T2108 hashtag. T2108-related trades and other trades are posted on twitter using the #120trade hashtag)

T2108 Status: 49%

VIX Status: 15.6%

General (Short-term) Trading Call: Hold with a bullish bias (important caveats noted below)

Reference Charts (click for view of last 6 months from Stockcharts.com):

S&P 500 or SPY

SDS (ProShares UltraShort S&P500)

U.S. Dollar Index (volatility index)

VIX (volatility index)

VXX (iPath S&P 500 VIX Short-Term Futures ETN)

EWG (iShares MSCI Germany Index Fund)

Commentary

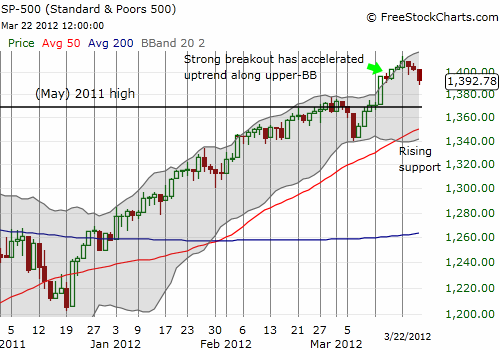

T2108 dropped to its lowest point of the year and lowest point in three months. Yet, the S&P 500 had another mild selling day losing a fraction of a percent. T2108 is dropping quickly even as the S&P 500 is ONLY 1.2% below its closing multi-year highs set at the beginning of this week. T2108 was last overbought for just one day on March 13; on that day, the S&P 500 made its big breakout move. The index is now just returning to the close of that day. I continue to interpret this stark divergence as bullish. At the current rates, T2108 will print oversold conditions just as the S&P 500 finally returns all its gains from the breakout. That moment will mark one of the more critical bear vs. bull junctures we have observed in a very long time. Even the steadily rising 50DMA may serve as support for that moment.

In my last T2108 update, I noted that at 59%, T2108 signaled the potential for further upside in the stock market simply by virtue of the strong likelihood of a return to overbought conditions. However, I failed to outline the scenario for a return to oversold conditions first. So, if you prefer to be bearish here, it is far from too late to enter a new position. However, I am guessing the potential returns are very small. Reversing the breakout move from here implies 1.7% downside in the S&P 500. Since I am still holding plenty of SDS (and, UGH, VXX) as hedges, I am not interested in getting even more aggressive with the bullish portfolio. Instead, I continue to focus on buying dips and flipping calls in SSO, the ProShares Ultra S&P 500, and buying VXX puts (which got a lot more expensive with today’s ugly collapse of TVIX!).

I bought two tranches of SSO calls today. I will buy more calls if the S&P 500 drops another 0.5% to 1.2% or so. IF the S&P 500’s breakout is completely reversed into a false breakout, all bets are off for the bullish case. In such a scenario, I will expect T2108 to be a very handy guide for navigating trading from that point. For now, I am not expecting a complete reversal.

Last night, I was motivated to do a chart review of FXI, the iShares Xinhua 25 Index Fund ETF given all the angst being spilled over a fifth consecutive contraction for Chinese manufacturing. In that post, I stated I could not get interested in the bearish case for FXI unless it closed at a new low. Well, it did. On heavy volume. So now FXI is officially on the bearish list even though I am positioning bullishly for the S&P 500.

Similarly, Caterpillar (CAT) continues to fade on heavy selling volume. If I did not have the bullish bias, I would have chased CAT on yesterday’s break below the 50DMA. If it breaks to a new low for the month, I will have to officially put it on the bearish list as well. In the meantime, I am holding onto puts on Terex (TEX) which I think has a LOT of downside potential if somehow the selling and bearish sentiment turns ugly.

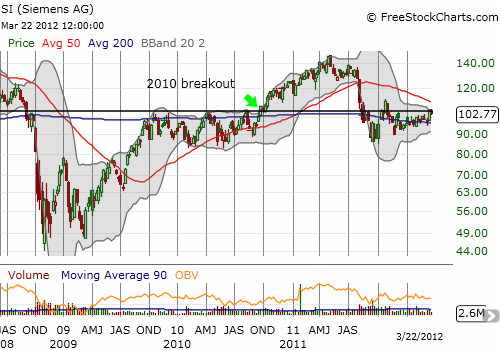

Reviewing FXI reminded me that I have not looked at stock charts from Europe in a very long time. I was surprised by the very mixed bag of performance and could not come up with a unifying theme except that nothing that I looked at, from stocks to ETFs, had returned to multi-year highs. Some country ETFs like Spain (EWP) and Italy (EWI) are so far away from that milestone, I cannot even imagine when they will gather enough momentum to retest those lofty levels. Even the Germany ETF (EWG) remains 21% below 2011’s high although it is up a nifty 20% this year. In other words, Europe is full of bargains which could look even better if a sell-off in the U.S. drags everyone else down. I will be waiting with open arms on the next Eurozone sell-off (for some more context, see “Nassim Taleb Likes Euros And You Should Too“). Here are weekly and daily charts (respectively) of Siemens (SI) to further deliver the point of Europe’s poor relative performance:

Siemens (SI) is up 7.3% for the year but is more than 40% off its recovery highs set in 2011. SI recently broke out for the third time in about six months over its 2010 breakout line. Siemens is a great example of the market’s memory regarding breakouts and the kind of selling that can occur after the market watches the entire breakout disappear. This time around, the sharply declining 200DMA added to the stiff resistance to gains above this line. SI is already at its critical juncture. Fail this latest test, and I strongly suspect the stock will drop to the lower 90s in short order.

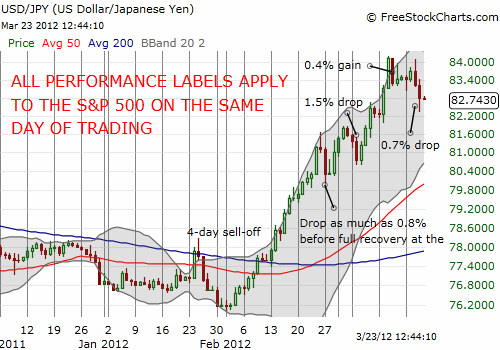

I conclude with a little forex (foreign exchange). I have written extensively about my expectations for the Japanese yen to weaken and now my surprise at just how weak the yen has become. Even more interesting now is the almost direct correlation between yen STRENGTH and stock market weakness. Trading in the yen is once again a useful barometer for the market’s current risk appetite. The chart below shows the recent run-up in USD/JPY (you can also see the decline in the yen ETF FXE). The days of market strength in the yen versus the dollar (the red bars) correspond to all the bigger down days in the market over the past two months. I have marked the S&P 500’s daily performance at the related points.

Again, the labels of performance on the chart refer to the S&P 500’s performance on the given day. Out of five RARE episodes of yen strength (where USD/JPY drops), the S&P 500 was markedly down on three of them. On another day, the S&P 500 sold off only to bounce back completely for a flat close. These correlations make me wonder whether the Japanese yen is getting sold (borrowing at low rates) to buy stocks. This is just speculation for now, but something to consider.

So, overall, I am maintaining my bullish bias and feel much better about it with T2108 a full 20 percentage points away from overbought levels. Recall that my bullish bias is based on my historical analysis of overbought periods. I will continue to flip quickly in and out of SSO calls and VXX puts as I expect the market to churn a lot up and down before T2108 gets “resolved” to oversold or overbought. If the current pace continues, T2108 could be oversold sometime next week. HOWEVER, T2108 is developing a VERY curious trend. The daily chart posted below at the time of this post shows T2108 making a series of higher lows since the gut-wrenching lows of last summer. This trend will only hold up, if T2108 stops its losses between 40% and current levels.

If the S&P 500’s breakout is violated at the same time T2108 flips oversold, I will have a really challenging decision to make…

Charts below are the latest snapshots of T2108 (and the S&P 500)

Refresh browser if the charts are the same as the last T2108 update.

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Weekly T2108

*All charts created using freestockcharts.com unless otherwise stated

Related links:

The T2108 Resource Page

Expanded daily chart of T2108 versus the S&P 500

Expanded weekly chart of T2108

Be careful out there!

Full disclosure: long SDS and VXX; long CAT calls, shares, and puts; long SSO calls, long TEX puts, long USD/JPY

I’m admittedly suffering from (bearish) confirmation bias, so take this with a grain of salt:

Everyone talks about the recent ‘break out’, but here’s my argument for the case that a meaningful break out hasn’t actually occurred even though we obviously see it in the price of the S&P 500:

First, let me establish the idea that breadth is important to us because of the belief that trends happen when they are broad based. This is why we consider T2108 useful: because it looks at the breadth of many, many stocks.

Ok, now take a look at how much Equal Weighted indices have surpassed their 2011 highs (negative numbers mean that the high has not been surpassed):

SPEW-X (SP500 Equal Weighted Index): -1.23%

NDXE-X (Nasdaq-100 Equal Weighted Index): 1.36%

EWRM (Russell Midcap Equal Weight ETF): -2.28%

EWRS (Russell 2000 Equal Weight ETF): -4.98%

EWRI (Russell 1000 Equal Weight ETF): -1.90%

Of these broad indices, almost all of them have still not ‘broken out’. If we consider that an equal weight index is approximately the behavior of the components, it suggests that the average stock has not broken out. In other words, people are still selling their stocks as they get close to the 2011 highs (as opposed to buying shares after a break out).

The data is similar for Equal Weighted sector ETFs (excluding the interesting case of Consumer Discretionary):

RCD (Consumer Discretionary): 5.33%

RGI (Industrial): -3.89%

RHS (Consumer Staples): 0.35%

RTM (Materials): -8.63%

RYE (Energy): -14.85%

RYF (Financial): -6.6%

RYH (Healthcare): -1.78%

RYT (Tech): -3.79%

RYU (Utilities): -3.61%

Anyway, all this data suggests to me that the ‘break out’ that we see in market-cap weighted indices like the S&P 500 are due to large caps doing better than the rest, but the S&P 500 ‘break out’ is not a broad-based move that all stocks are participating in. And broad-based moves are what we’re interested in, that’s why we watch breadth indicators like T2108. (In other words, if you believe in using T2108, then you might believe in the argument I’ve laid out above :-)).

I fully agree with you and perhaps I have not stated it strongly enough in recent posts. T2108 suggests that the leaders are thinning and the performance in an index like the S&P 500 is due to the strength of fewer and fewer stocks. Now, having said that, in typical moments, I would suggest this is bearish. But the context I am using is that we just went through an historic overbought period. History demonstrates that the aftermath of such overbought periods is not a massive sell-off but instead an eventual continuation of the rally. With THAT in mind, I have to keep quieting the bearish imp whispering in my left ear.

Time will soon tell but until it does, I fully expect the market to churn a lot and for bears to get disappointed by the continued lack of follow-through inselling pressure.

Now, T2108 is far from overbought, so I have one more excuse not to get overly bearish. 🙂

I forgot to add that because I am fundamentally bullish, I interpreted the brief divergence of T2108 and the S&P 500 as indicating there is headroom for lagging stocks to catch up, thus providing the extra powder for the index to eventually go even higher.

I see I also made a mistake here. I said I am not interested in getting more aggressive with the “bullish portfolio” when I meant the “bearish portfolio.”