(T2108 measures the percentage of stocks trading above their respective 40-day moving averages [DMAs]. To learn more about it, see my T2108 Resource Page.)

T2108 Status: 19% and day #2 of the current oversold period.

VIX Status: 23; the max intra-day high occurred on day #2 of the oversold period, 14% above the highs from day #1.

General (Short-term) Trading Call: Cover more shorts, add more longs.

Commentary

T2108 slipped slightly further into oversold territory at 19%. The S&P 500 ended the day flat after making a picture perfect bounce off the 200-day moving average (DMA). Conditions seem ripe to begin an oversold bounce but the declining T2108 produced a bearish divergence with the S&P 500. The VIX did not reach the height I would have liked, but it was sufficient to increase my aggressiveness in adding to longs.

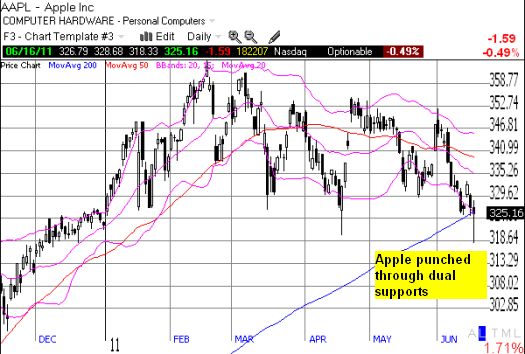

Interestingly enough, Apple (AAPL) had the exact kind of day I was looking for out of the S&P 500 to provide a foundation for an oversold bounce. Late in the day, AAPL quickly plunged below dual supports at the 200DMA and then the 2011 lows from April before rebounding just as sharply as it dropped. I strongly suspect a lot of stops were taken out.

I will repeat part of yesterday’s discussion that introduced the VIX as a complementary signal to an oversold T2108. (Note the inclusion of VIX information in the status summary above).

I have done analysis in the past on timing buys in oversold periods. I use the volatility index (VIX) to provide additional clues. In 2008, I wrote “Does the VIX Need to Spike at A Climactic Low?“, and I concluded that a “good enough” rule of thumb is to buy when the VIX gets within 20% of the last spike. At the 2011 lows in March, the VIX got as high as 31. A move to 25 gets the VIX within 20% of that spike; the VIX reached 25 today…without punching through the 200DMA and March lows as I originally expected.

Although the VIX triggered the “20% rule” today, the rule is incomplete because the VIX may not get as high as 20% from the previous spike. Last year I updated my T2108 vs VIX study with an article in Stocks, Futures and Options (SFO) Magazine called “Trade the Oversold Bounce” (free registration required). In that piece, I developed more sophisticated rules for speculating on bottoms:

“Lower risk tolerance (conservative trader): buy once [the] VIX increases 20 percent from the first oversold day or buy the first day after the oversold period ends, whichever comes first.

Higher risk tolerance (aggressive trader): buy on the first oversold day, recognizing that 56 percent of all oversold periods last only one or two days. This strategy eliminates dependence on [the] VIX.

Traders with moderate risk tolerances can combine these strategies by allocating an appropriate amount of capital to each approach.”

Conservative traders will have to remain patient for now.

Watch out for fireworks during tomorrow’s options expiration.

Charts below are the latest snapshots of T2108 (and the S&P 500)

Refresh browser if the charts are the same as the last T2108 update.

Daily T2108 vs the S&P 500

Black line: T2108 (measured on the right); Red line: S&P 500 (for comparative purposes)

Weekly T2108

*All charts created using TeleChart:

Related links:

The T2108 Resource Page

Expanded daily chart of T2108 versus the S&P 500

Expanded weekly chart of T2108

Be careful out there!

Full disclosure: long SSO puts