The risk of holding TBT, the Pro Shares UltraShort 20+ Year Treasury, rose significantly last week. The sudden surge in oil prices in response to the rebellion in Libya has put the double-dip recession back into play and once again lodged it into the frontal lobes of market players. Recession fears bring fresh affinity for “safety” buying in U.S. treasury bonds and put positions in TBT at risk.

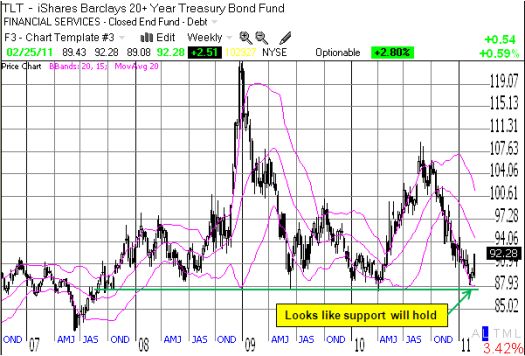

For example, TLT, the iShares Barclays 20+ Year Treasury Bond Fund seems to have survived a retest of a long-term support line.

The bounce in TLT is driving TBT lower. TBT’s primary uptrend has ended and a critical retest of the 200DMA is coming up.

Just two weeks ago, I was anticipating a continuation of the rally in TBT as part of the overall call for a top in bonds. So, if TBT breaks support at the 200DMA, I will be dumping my position very reluctantly. After that point, I will watch for TLT to break its support as one potential signal to scramble back into TBT (I would also buy back into TBT if it drops low enough, like challenging the lows from 2010).

On the other hand, re-establishing a position in TIPS through the iShares Barclays TIPS Bond Fund (TIP) has paid off so far. In fact, TIP has torn right through upper resistance and looks ready to run again.

*All charts created using TeleChart:

The increasing potential for another recession will force a rethink of investing and trading approaches that have done quite well during the recent market rally. One key technical indicator I have been watching much more closely is T2108, the percentage of stocks trading above their 40DMAs. Friday’s rally rapidly returned T2108 close to overbought conditions. This could be T2108’s last visit to overbought territory for a long while.

Full disclosure: long TBT, TIP