Earlier this week, I suggested setting up a pairs trade between Goldman Sachs (GS) and Deutsche Bank Ag (DB) to take advantage of an apparent growing divergence in performance between the two financial giants. My main recommendation rested on a put spread for GS and a call spread for DB. After thinking about the structure another day, I realized that the upside potential is too limited for a pairs trade based on options spreads. A better structure is one that allows broad potential upside on either side of the trade. The options spreads nullify the high premiums in the options. However, these premiums should also remain high for quite some time as proven by today’s announcement of a criminal investigation into GS, a series of critical downgrades, and the on-going barrage of new eurozone sovereign debt announcements.

The new structure for the pairs trade is 1 July 140 put on GS for every 2 July 85 calls on DB. Given the wide spread in DB options, it took a day for my trade to execute (see related postings here on Twitter), and that turned out to be a blessing in disguise. GS was still bouncing from a relief rally after Congressional hearings lambasting GS, and DB was dropping at the open on more eurozone debt drama.

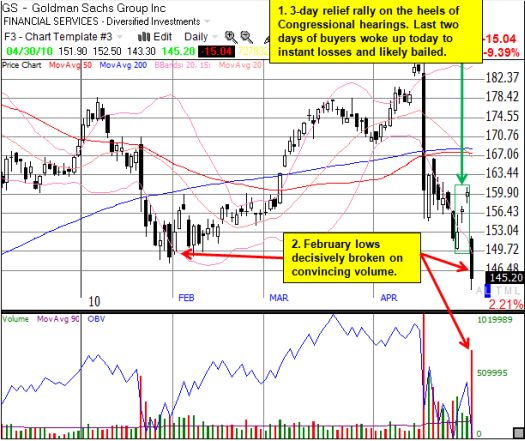

This trade is already more dynamic than I expected. Goldman’s 10% plunge today brought enough profit on my put that I was able to sell it to pay for the DB calls. The pairs trade is now riding on “house’s money.” I will look to repurchase puts on GS on another bounce. Such a bounce could prove elusive for a while. The ferocity of today’s selling was likely at least partially driven by the large number of trapped buyers who were forced to scramble and jettison their shares. The chart below shows how buyers from the previous two days where suddenly given no other option but to sell at a loss or risk further losses.

In the meantime, DB has been churning directly below the resistance formed by the convergence of the 50 and 200DMA. Technically, it is a short here. If I do not get another near-term opportunity to purchase GS puts at lower prices, I might play off the DB calls with a short on DB shares.

*All charts created using TeleChart:

Be careful out there!

Full disclosure: long GS shares and long GS put spread (not related to pairs trade), long DB calls